Silver Elephant Prepares 12-Hole Drill Program at Paca Silver Project in Bolivia

Vancouver, British Columbia, February 14, 2023 – Silver Elephant Mining Corp. (“Silver Elephant” or “the Company”) (TSX:ELEF, OTCQX:SILEF, Frankfurt:1P2N) announces it is preparing a drilling program at the Paca silver oxide open-pit deposit, which is part of the Company’s 100%-controlled Pulacayo silver-lead-zinc project in Bolivia.

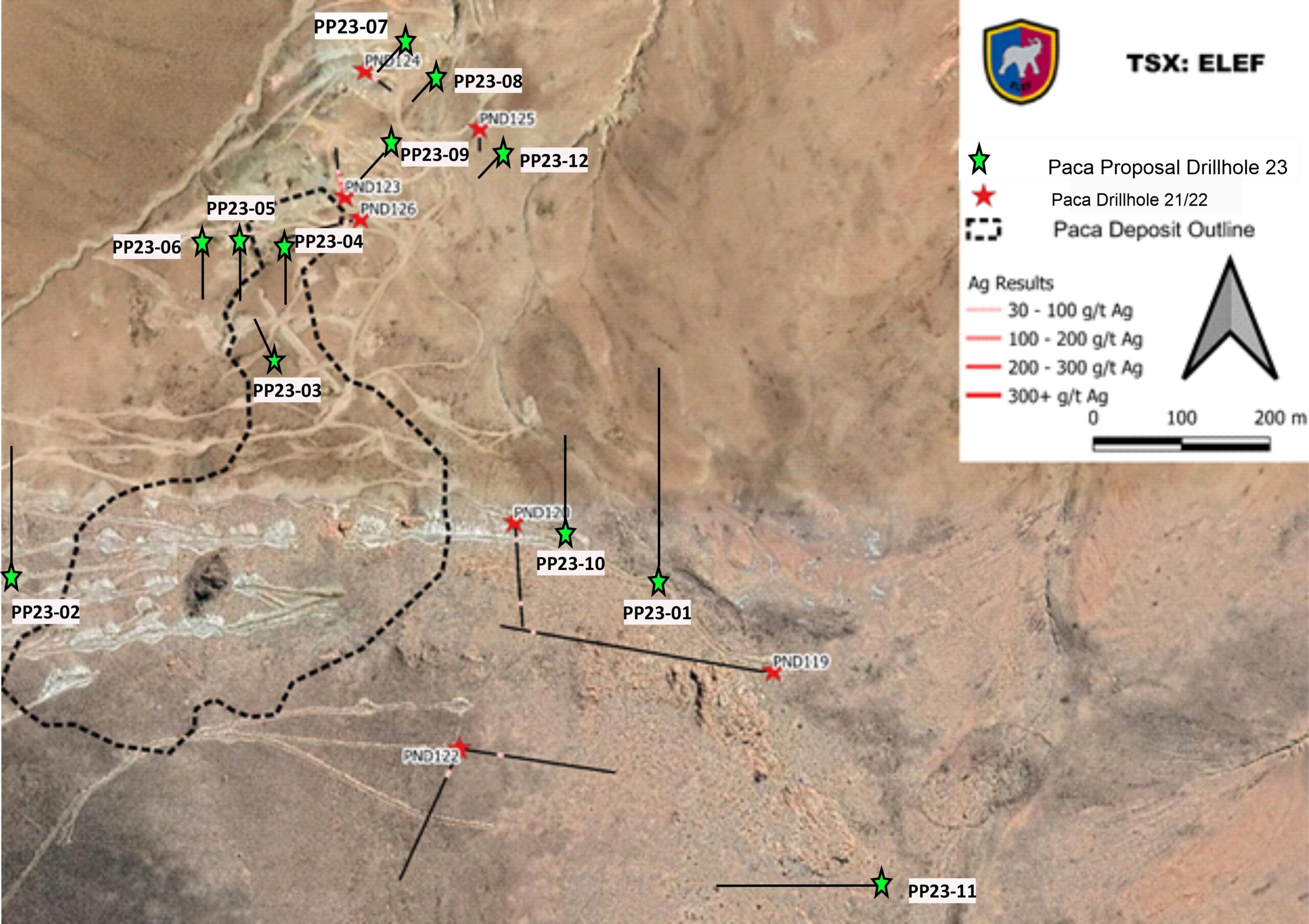

This drill program is a follow-up to the successful 2022 drill program (see March 29, 2022 news release) highlighted by PND 123 which was collared at the northern edge of the Paca resource and drilled farther north. The hole intercepted 27 meters of 159 g/t silver from near-surface, including 1.5 meters of 565 g/t silver*. All four step-out holes drilled in 2022 (PND 123, 124, 125 & 126) intercepted silver mineralization. They also demonstrated that the northern extension of Paca oxide resource is open to the north and to the northeast.

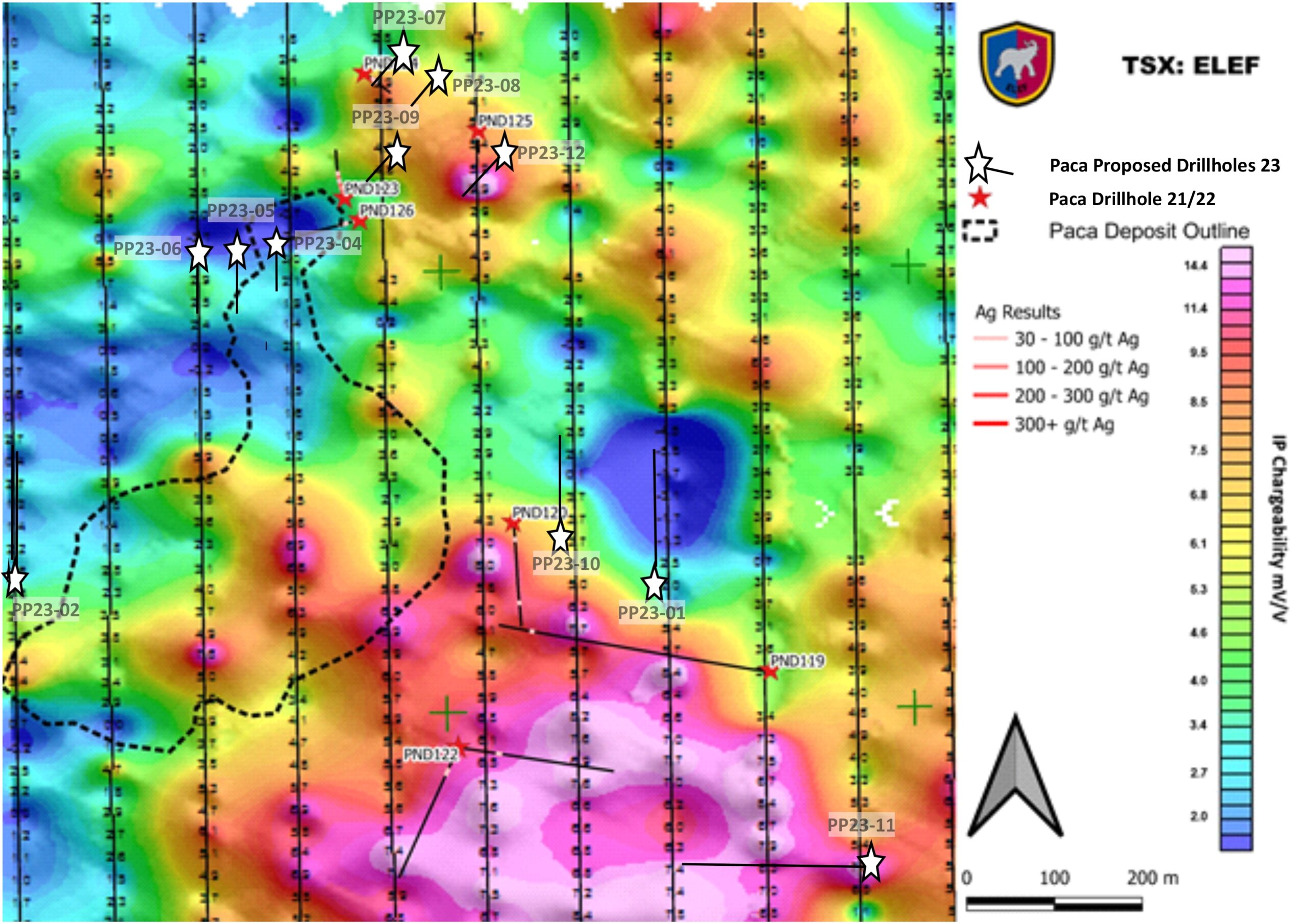

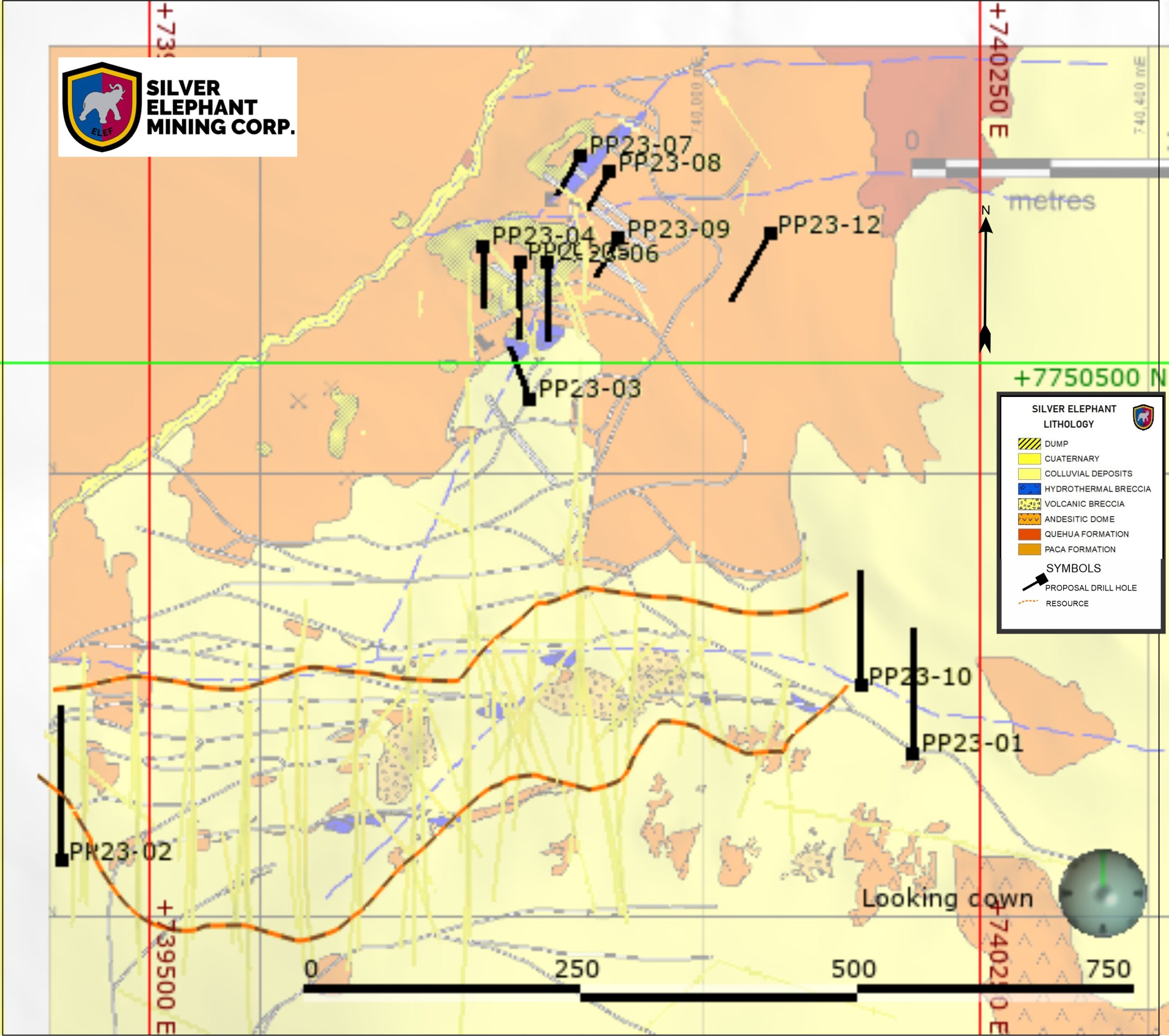

The proposed 12-hole Paca drill program totals 1,510 meters. Eight drill holes target further expansion to Paca North oxide discovery, based on available drilling, mapping, sampling, and geophysical data. Two drill holes will test the east and west extensions of the Paca main zone. The two remaining drill holes will test Induced-Polarization anomalies located southeast of the Paca Dome.

“Paca project development is being fast-tracked given current high silver price ($23/oz). In particular, Paca North’s shallow oxide resource and flat-tabular morphology are well-suited to a potential open-pit operation with low processing cost. The 2023 Pulacayo–Paca plan includes a prefeasibility study and continued environmental permitting efforts for an open-pit mining, oxide leach processing operation at Paca which can later transition to sulphide flotation processing.”, commented John Lee, CEO of Silver Elephant.

The 2022 Paca drill results are summarized in the following table:

| Paca North Oxide Discovery | |||||||

| Hole ID | From | To | Width (m) | Ag (g/t) | Pb % | Zn % | AgEq (g/t) |

| PND123 | 3.0 | 30.0 | 27.0 | 159 | 0.28 | 0.05 | 154 |

| incl… | 7.5 | 9.0 | 1.5 | 565 | 0.30 | 0.08 | 518 |

| PND123 | 37.5 | 45.0 | 7.5 | 68 | 0.11 | 0.07 | 67 |

| PND124 | 0.0 | 28.5 | 28.5 | 22 | 0.42 | 0.73 | 63 |

| incl… | 15.0 | 27.0 | 12.0 | 21 | 0.54 | 1.29 | 88 |

| PND125 | 0.0 | 18.8 | 18.8 | 33 | 0.20 | 0.52 | 56 |

| incl… | 10.4 | 15.4 | 5.0 | 80 | 0.40 | 1.13 | 130 |

| PND126 | 0.0 | 31.0 | 31.0 | 31 | 0.22 | 0.09 | 39 |

| incl… | 29.0 | 31.0 | 2.0 | 78 | 0.27 | 0.08 | 82 |

*Note: Reported widths are intercepted core lengths and not true widths, as relationships with intercepted structures and contacts vary. Based on core-angle measurements, true widths range from 75% to 85% of the reported core length. Please see note on AgEq calculation in preceding paragraphs. Sulphide zone metal recoveries of 89.2% for Ag, 91.9% for Pb and 82.9% for Zn were used in the silver equivalent (recovered) equation and reflect metallurgical testing results disclosed previously for the Pulacayo deposit. Silver equivalents are noted where “AgEq” = silver equivalent (recovered) and is equal to (Ag g/t * 89.2%) + ((Pb% * (US$0.95/lb. Pb / 14.583 Troy oz./lb. / US$17 per Troy oz. Ag) * (10,000 * 91.9%)) + ((Zn% * (US$1.16/lb. Zn / 14.583 Troy oz./lb. / US$17 per Troy oz. Ag) * (10,000 * 82.9%)).

The Paca deposit contains an indicated 37 million oz of silver and an inferred 6 million oz of silver, much of it regarded as a manto-style deposit. Most of the near-surface mineralization at Paca is classified as an oxide-silver resource containing an indicated 5.9 million oz of silver at 231g/t (800,000 tonnes) and an inferred 1.2 million oz of silver at 159g/t (235,000 tonnes).

Paca Deposit Pit-Constrained Mineral Resource Estimate – Effective Date October 13, 2020**

| Cut -off Grade |

Zone | Category | k Tonnes |

Ag g/t | Zn % | Pb % | Ag Moz |

Zn Mlbs |

Pb Mlbs |

*AgEq Moz |

*AgEq g/t |

| 50 Ag g/t | Oxide In-Pit |

Indicated | 1,095 | 185 | 6.5 | ||||||

| Inferred | 345 | 131 | 1.5 | ||||||||

| 30 *AgEq g/t |

Sulphide In-Pit |

Indicated | 20,595 | 46 | 1.07 | 0.67 | 30.5 | 485.8 | 304.2 | 70.2 | 106 |

| Inferred | 3,050 | 46 | 0.76 | 0.65 | 4.5 | 51.1 | 43.7 | 9.2 | 94 | ||

| Total: | Indicated | 21,690 | 37 | 485.8 | 304.2 | 70.2 | |||||

| Inferred | 3,395 | 6 | 51.1 | 43.7 | 9.2 | ||||||

Paca Deposit Pit-Constrained Cut-Off Grade Sensitivity Report for Oxide Zone**

| Cut -off Grade | Category | k Tonnes |

Ag g/t | Ag Moz |

| 30 Ag g/t | Indicated | 1,805 | 128 | 7.4 |

| Inferred | 500 | 102 | 1.6 | |

| 45 Ag g/t | Indicated | 1,225 | 170 | 6.7 |

| Inferred | 375 | 124 | 1.5 | |

| 90 Ag g/t | Indicated | 800 | 231 | 5.9 |

| Inferred | 235 | 159 | 1.2 | |

| 200 Ag g/t | Indicated | 420 | 311 | 4.2 |

| Inferred | 55 | 285 | 0.5 | |

| 400 Ag g/t | Indicated | 80 | 493 | 1.3 |

| Inferred | 5 | 459 | 0.1 |

Note: Cut-off grade for pit-constrained oxide Mineral Resources is 50 g/t Ag.

The Paca deposit is 7 kilometers north of the Pulacayo deposit (the Tajo vein). It is part of the global Pulacayo resource, which contains an indicated resource of 106.7 million oz of silver, 1.38 billion pounds of zinc, and 690 million pounds of lead and an inferred resource of 13.1 million oz of silver, 123 million pounds of zinc, and 62 million pounds of lead.

Pulacayo Global Mineral Resource Estimate – Effective October 13, 2020**

| Zone | Category | Rounded Tonnes | Ag Moz | Zn Mlbs | Pb Mlbs | AgEq* Moz |

| Open Pit Constrained | Indicated | 47,380,000 | 101.0 | 1,365.0 | 687.5 | 202.0 |

| Inferred | 4,165,000 | 8.0 | 80.3 | 53.5 | 14.3 | |

| Out-of-Pit | Indicated | 660,000 | 5.7 | 19.6 | 6.4 | 6.5 |

| Inferred | 900,000 | 5.2 | 42.4 | 8.3 | 7.4 | |

| Total: | Indicated | 48,040,000 | 106.7 | 1,384.7 | 693.9 | 208.5 |

| Inferred | 5,065,000 | 13.1 | 122.8 | 61.9 | 21.7 |

Pulacayo Deposit Mineral Resource Estimate – Effective Date October 13, 2020**

| Cut -off Grade | Zone | Category | Rounded Tonnes | Ag g/t | Zn % | Pb % | Ag Moz | Zn Mlbs | Pb Mlbs |

*AgEq Moz |

*AgEq g/t |

| 50 Ag g/t | Oxide In-Pit | Indicated | 1,090,000 | 125 | 4.4 | ||||||

| Inferred | 25,000 | 60 | 0.0 | ||||||||

| 30 *AgEq g/t | Sulphide In-Pit | Indicated | 24,600,000 | 76 | 1.63 | 0.70 | 60.1 | 884.0 | 379.6 | 123.4 | 156 |

| Inferred | 745,000 | 82 | 1.79 | 0.61 | 2.0 | 29.4 | 10.0 | 3.9 | 164 | ||

| 100 *AgEq g/t | Sulphide Out-of-Pit | Indicated | 660,000 | 268 | 1.35 | 0.44 | 5.7 | 19.6 | 6.4 | 6.5 | 307 |

| Inferred | 900,000 | 179 | 2.14 | 0.42 | 5.2 | 42.4 | 8.3 | 7.4 | 257 | ||

| Total: | Indicated | 26,350,000 | 70.2 | 903.7 | 386.0 | 133.4 | |||||

| Inferred | 1,670,000 | 7.2 | 71.8 | 18.4 | 11.4 | ||||||

**The Pulacayo resource and Paca resource was prepared by Mercator Geological Services Limited with an effective date of October 13, 2020, with details provided in the Company’s October 13, 2020 news release. These resources are well supported by 96,021 meters of drilling (5,009 meters by Apex Silver from 1994 to 1998, 85,024 meters by Apogee Silver from 2002 to 2014, and 6,258 meters by Silver Elephant from 2019 to 2022).

Please visit www.silverelef.com to see Paca maps pertaining to this release.

Qualified Person

The technical contents of this news release have been prepared under the supervision of Osvaldo Arce Burgoa, who isis an independent consultant of the Company. Osvaldo Arce Burgoa is a qualified person as defined by the guidelines of NI 43-101.

Quality Assurance and Quality Control

Silver Elephant adopts industry-recognized best practices in its implementation of QA/QC methods. Rock chip samples average between 5-7 kilograms. Samples are shipped to ALS Global Laboratories in Oruro, Bolivia for preparation and then shipped to ALS Global laboratories in Lima, Peru for analysis. Samples are analyzed using Intermediate Level Four Acid Digestion. Silver over limits (“ore grade”) are analyzed using fire assay with a gravimetric finish. The ALS Laboratories sample management system meets all the requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. All ALS geochemical hub laboratories are accredited to ISO/IEC 17025:2017 for specific analytical procedures. A geochemical standard control sample is inserted into the sample stream. The laboratory also includes duplicates of samples, standards and blanks for additional QA/QC. Check assays are reviewed prior to the release of data. Assays are also reviewed for their geological context and checked against field descriptions.

About Silver Elephant

Silver Elephant Mining Corp. is a premier silver mining and exploration company, with its flagship Pulacayo silver project in Bolivia. It also owns 100% of Mega Thermal Coal Corp and 39% of Oracle Commodity Holding Corp. (“Oracle”). Oracle has equity and royalty investments in nickel and vanadium mining.

Further information on Silver Elephant can be found at www.silverelef.com.

SILVER ELEPHANT MINING CORP.

ON BEHALF OF THE BOARD

“John Lee”

Chief Executive Officer

For more information about Silver Elephant, please contact:

+1.604.569.3661 ext. 101

info@silverelef.com www.silverelef.com

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, including statements which may contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions, and statements related to matters which are not historical facts are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management’s expectations regarding Company’s future growth, results of operations, performance, and business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.

These factors should be considered carefully, and readers should not place undue reliance on the Company’s forward-looking statements. The Company believes that the expectations reflected in the forward-looking statements contained in this news release and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events, or results not to be as anticipated, estimated, or intended. The Company undertakes no obligation to publicly release any future revisions to forward-looking statements to reflect events or circumstances after the date of this news or to reflect the occurrence of unanticipated events, except as expressly required by law.