Silver Elephant Drills 17.45 Meters Grading 120 g/t Silver at Paca in Bolivia

Vancouver, British Columbia – September 11,2024 — Silver Elephant Mining Corp. (“Silver Elephant” or the “Company”) (TSX: ELEF, OTCQB: SILEF, Frankfurt: 1P2) is pleased to announce diamond drill results from the Paca deposit (“Paca”) within its 100%-controlled Pulacayo-Paca silver project in the Potosi department in Bolivia.

Further to the Company’s news release dated June 12, 2024, a total of 28 holes were drilled in the Paca north area totaling 1,458 meters. The results for the previous 20 holes were announced in the Company’s news releases dated July 22, 2024 and August 7, 2024. The assays for the remaining 8 holes (4 exploration, 4 infill) have been received and are reported below.

Notable results include PC24-27 which intercepted 17.45 meters of 120 g/t silver from surface, and PC24-25 which intercepted 13.72 meters of 118 g/t silver from surface. Hole PC24-28, which is a 250 meter northwest step-out from the Paca resource envelope, intercepted 2.95 meters grading 38.9 g/t Silver The Company will review the drill results and incorporate them into the Paca resource model.

In addition, and further to the news release dated July 8, 2024, regarding phase one sulphide mining, the Company is on track to start the 367-meter tunnel development at the Paca dome in September 2024 and deliver the first Paca sulphide concentrate sale before the end of 2024.

This drill program was paid for by Andean Precious Metals Corp. (“Andean”). Pursuant to the sales and purchase agreement and master services agreement detailed in the Company’s news release dated September 12, 2023, Silver Elephant plans to sell and deliver up to 800,000 tonnes of Paca oxide materials to Andean for a total of between US$5 million and US$7 million depending on the silver price. At the current silver price and production run rate, the Company expects to receive US$2.5 million before January 31, 2025. Andean has also agreed to reimburse Silver Elephant for operating expenses under the sales and purchase agreement.

| EXPANSION DRILLING | |||||||

| HOLE ID | From (m) | To (m) | Length (m) | True Width (m) | Ag (g/t) | Pb (%) | Zn (%) |

| PC24-02 | 0 | 40.2 | 40.2 | 28.43 | 20 | 0.32 | 0.52 |

| Incl. | 7.2 | 14.5 | 7.3 | 5.16 | 31 | 0.31 | 0.13 |

| Incl. | 25.6 | 26.9 | 1.3 | 0.92 | 41 | 0.43 | 0.24 |

| PC24-06 | 0 | 81.4 | 81.4 | 57.55 | 7 | 0.02 | 0.06 |

| Incl. | 3 | 12 | 9 | 6.36 | 9 | 0.03 | 0.07 |

| And | 37.5 | 39 | 1.5 | 1.06 | 9 | 0.003 | 0.02 |

| PC24-13 | 0 | 33.6 | 33.6 | 33.60 | 12.98 | 0.48 | 0.32 |

| Incl. | 5.1 | 6.6 | 1.5 | 1.50 | 33.3 | 0.43 | 0.14 |

| PC24-28 | 38.5 | 41.5 | 3 | 2.95 | 38.9 | 0.001 | 0.004 |

| Incl. | 40 | 41.5 | 1.5 | 1.48 | 60.9 | 0,001 | 0.004 |

| INFILL DRILLING | |||||||

| HOLE ID | From (m) | To (m) | Length (m) | True Width (m) | Ag (g/t) | Pb (%) | Zn (%) |

| PC24-05 | 0 | 17.8 | 17.8 | 12.59 | 26 | 0.17 | 0.34 |

| Incl. | 3 | 4.5 | 1.5 | 1.06 | 47 | 0.08 | 0.26 |

| And | 23.8 | 29.3 | 5.5 | 3.89 | 108 | 0.2 | 0.57 |

| Incl. | 25.3 | 26.3 | 1 | 0.71 | 131 | 0.14 | 0.55 |

| Incl. | 27.8 | 29.3 | 1.5 | 1.06 | 190 | 0.24 | 0.65 |

| PC24-25 | 0 | 35.6 | 35.6 | 25.17 | 56 | 0.35 | 0.08 |

| Incl. | 21.88 | 35.6 | 13.72 | 9.70 | 118 | 0.53 | 0.05 |

| Incl. | 21.88 | 30.48 | 8.6 | 6.08 | 131 | 0.38 | 0.05 |

| Incl. | 24.08 | 25.36 | 1.28 | 0.91 | 192 | 0.28 | 0.03 |

| And | 45.84 | 56.1 | 10.26 | 7.25 | 27 | 0.22 | 0.06 |

| Incl. | 50.96 | 53.52 | 2.56 | 1.81 | 63 | 0.27 | 0.06 |

| Incl. | 50.96 | 52.24 | 1.28 | 0.91 | 87 | 0.32 | 0.07 |

| PC24-26 | 0 | 28.1 | 28.1 | 28.1 | 45 | 0.4 | 0.27 |

| Incl. | 10.5 | 25.1 | 14.6 | 14.6 | 61 | 0.5 | 0.24 |

| Incl. | 14.6 | 18.1 | 3.5 | 3.5 | 77 | 0.67 | 0.24 |

| PC24-27 | 0 | 26.9 | 26.9 | 26.9 | 90 | 0.56 | 0.21 |

| Incl. | 8.9 | 26.35 | 17.45 | 17.45 | 120 | 0.65 | 0.25 |

| Incl. | 17.6 | 22.6 | 5 | 5 | 228 | 0.94 | 0.24 |

| Incl. | 18.6 | 19.6 | 1 | 1 | 322 | 0.57 | 0.25 |

| Incl. | 21.6 | 22.6 | 1 | 1 | 273 | 1.79 | 0.29 |

| Incl. | 24.2 | 25.25 | 1.05 | 1.05 | 149 | 0.8 | 0.23 |

The drill program continues to confirm a highly deformed, disseminated mineralization located within a north-south structural trend and potential for resource expansion.

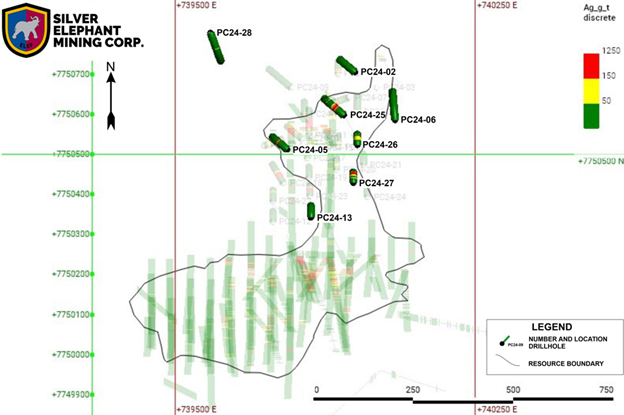

Drill-hole locations and Paca resource boundary shown below:

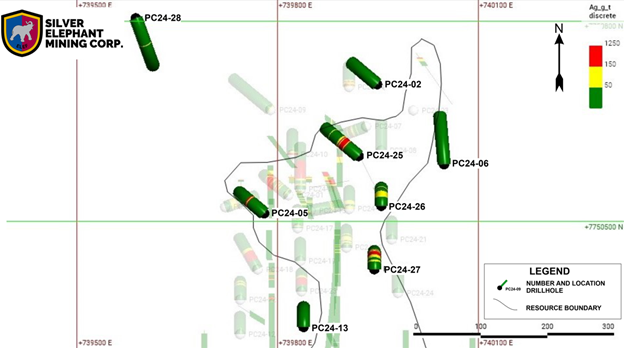

Close-up view of drill-hole locations shown below:

The full result from this drill program is presented below:

| INFILL DRILLING | |||||||

| HOLE ID | From | To | Length | True Width (m) | Ag (g/t) | Pb (%) | Zn (%) |

| PC24-01 | 1.5 | 39.65 | 38.15 | 33.04 | 83 | 0.58 | 0.14 |

| Incl. | 14.15 | 21.65 | 7.5 | 6.50 | 91 | 0.46 | 1.12 |

| Incl. | 18.65 | 20.15 | 1.5 | 1.30 | 190 | 0.75 | 0.08 |

| Incl. | 26.15 | 39.65 | 13.5 | 11.69 | 140 | 0.55 | 0.15 |

| Incl. | 29.15 | 32.15 | 3 | 2.60 | 183 | 0.41 | 0.09 |

| Incl. | 33.65 | 38.15 | 4.5 | 3.90 | 198 | 0.84 | 0.14 |

| PC24-03 | 0 | 35.3 | 35.3 | 22.69 | 83 | 0.42 | 0.08 |

| Incl. | 1.5 | 15.5 | 14 | 9.00 | 88 | 0.47 | 0.1 |

| Incl. | 6 | 7.5 | 1.5 | 0.96 | 155 | 0.18 | 0.08 |

| Incl. | 19.3 | 32.8 | 13.5 | 8.68 | 109 | 0.32 | 0.06 |

| Incl. | 23.8 | 26.8 | 3 | 1.93 | 156 | 0.32 | 0.04 |

| Incl. | 28.3 | 31.3 | 3 | 1.93 | 163 | 0.29 | 0.04 |

| PC24-05 | 0 | 17.8 | 17.8 | 12.59 | 26 | 0.17 | 0.34 |

| Incl. | 3 | 4.5 | 1.5 | 1.06 | 47 | 0.08 | 0.26 |

| and | 23.8 | 29.3 | 5.5 | 3.89 | 108 | 0.2 | 0.57 |

| Incl. | 25.3 | 26.3 | 1 | 0.71 | 131 | 0.14 | 0.55 |

| Incl. | 27.8 | 29.3 | 1.5 | 1.06 | 190 | 0.24 | 0.65 |

| PC24-06 | 0 | 81.4 | 81.4 | 57.55 | 7 | 0.02 | 0.06 |

| Incl. | 3 | 12 | 9 | 6.36 | 9 | 0.03 | 0.07 |

| and | 37.5 | 39 | 1.5 | 1.06 | 9 | 0.003 | 0.02 |

| PC24-07 | 10.76 | 30.83 | 20.07 | 14.19 | 52 | 0.56 | 0.4 |

| Incl. | 17.8 | 27.35 | 9.55 | 6.75 | 82 | 0.91 | 0.23 |

| Incl. | 17.8 | 23.64 | 5.84 | 4.13 | 102 | 1.17 | 0.07 |

| PC24-08 | 0 | 15 | 15 | 15.00 | 19 | 0.16 | 0.15 |

| Incl. | 0 | 3 | 3 | 3.00 | 31 | 0.21 | 0.16 |

| PC24-10 | 0 | 14.25 | 14.25 | 14.25 | 70 | 0.1 | 0.07 |

| Incl. | 0 | 5 | 5 | 5.00 | 162 | 0.13 | 0.05 |

| Incl. | 0 | 2 | 2 | 2.00 | 289 | 0.15 | 0.05 |

| PC24-11 | 2.69 | 43.75 | 41.06 | 29.03 | 237 | 1.1 | 0.1 |

| Incl. | 15 | 41.25 | 26.25 | 18.56 | 344 | 0.89 | 0.09 |

| Incl. | 15 | 18.75 | 3.75 | 2.65 | 438 | 0.95 | 0.14 |

| Incl. | 37.5 | 40 | 2.5 | 1.77 | 419 | 0.19 | 0.08 |

| PC24-15 | 0 | 6 | 6 | 3.86 | 35 | 0.21 | 0.11 |

| and | 23 | 33.75 | 10.75 | 6.91 | 47 | 0.47 | 0.12 |

| Incl. | 28.35 | 33.75 | 5.4 | 3.47 | 74 | 0.41 | 0.1 |

| Incl. | 31.05 | 32.4 | 1.35 | 0.87 | 133 | 0.52 | 0.09 |

| PC24-16 | 0 | 22.33 | 22.33 | 22.33 | 44 | 0.27 | 0.13 |

| Incl. | 0 | 10.31 | 10.31 | 10.31 | 64 | 0.16 | 0.15 |

| Incl. | 1.22 | 2.45 | 1.23 | 1.23 | 93 | 0.14 | 0.24 |

| PC24-17 | 0 | 28.6 | 28.6 | 28.60 | 42 | 0.47 | 0.19 |

| Incl. | 1.4 | 2.9 | 1.5 | 1.50 | 70 | 0.05 | 0.2 |

| Incl. | 10.4 | 11.8 | 1.4 | 1.40 | 60 | 0.69 | 0.12 |

| PC24-19 | 6 | 23.96 | 17.96 | 17.96 | 34 | 0.36 | 0.16 |

| Incl. | 20.67 | 23.96 | 3.29 | 3.29 | 46 | 0.81 | 0.14 |

| Incl. | 23.62 | 23.96 | 0.34 | 0.34 | 63 | 0.27 | 0.13 |

| PC24-24 | 1.5 | 18.15 | 16.65 | 16.65 | 21 | 0.52 | 1.04 |

| Incl. | 5.4 | 11.31 | 5.91 | 5.91 | 30 | 0.38 | 0.27 |

| PC24-25 | 0 | 35.6 | 35.6 | 25.17 | 56 | 0.35 | 0.08 |

| Incl. | 21.88 | 35.6 | 13.72 | 9.70 | 118 | 0.53 | 0.05 |

| Incl. | 21.88 | 30.48 | 8.6 | 6.08 | 131 | 0.38 | 0.05 |

| Incl. | 24.08 | 25.36 | 1.28 | 0.91 | 192 | 0.28 | 0.03 |

| and | 45.84 | 56.1 | 10.26 | 7.25 | 27 | 0.22 | 0.06 |

| Incl. | 50.96 | 53.52 | 2.56 | 1.81 | 63 | 0.27 | 0.06 |

| Incl. | 50.96 | 52.24 | 1.28 | 0.91 | 87 | 0.32 | 0.07 |

| PC24-26 | 0 | 28.1 | 28.1 | 28.1 | 45 | 0.4 | 0.27 |

| Incl. | 10.5 | 25.1 | 14.6 | 14.6 | 61 | 0.5 | 0.24 |

| Incl. | 14.6 | 18.1 | 3.5 | 3.5 | 77 | 0.67 | 0.24 |

| PC24-27 | 0 | 26.9 | 26.9 | 26.9 | 90 | 0.56 | 0.21 |

| Incl. | 8.9 | 26.35 | 17.45 | 17.45 | 120 | 0.65 | 0.25 |

| Incl. | 17.6 | 22.6 | 5 | 5 | 228 | 0.94 | 0.24 |

| Incl. | 18.6 | 19.6 | 1 | 1 | 322 | 0.57 | 0.25 |

| Incl. | 21.6 | 22.6 | 1 | 1 | 273 | 1.79 | 0.29 |

| Incl. | 24.2 | 25.25 | 1.05 | 1.05 | 149 | 0.8 | 0.23 |

| EXPANSION DRILLING | |||||||

| HOLE ID | From | To | Length | True Width (m) | Ag (g/t) | Pb (%) | Zn (%) |

| PC24-02 | 0 | 40.2 | 40.2 | 28.43 | 20 | 0.32 | 0.52 |

| Incl. | 7.2 | 14.5 | 7.3 | 5.16 | 31 | 0.31 | 0.13 |

| Incl. | 25.6 | 26.9 | 1.3 | 0.92 | 41 | 0.43 | 0.24 |

| PC24-04 | 0 | 31.05 | 31.05 | 31.05 | 46 | 0.2 | 0.06 |

| Incl. | 0 | 9 | 9 | 9.00 | 115 | 0.37 | 0.05 |

| Incl. | 1.5 | 4.5 | 3 | 3.00 | 143 | 0.47 | 0.05 |

| Incl. | 6 | 7.5 | 1.5 | 1.50 | 151 | 0.32 | 0.07 |

| PC24-09 | 0 | 5 | 5 | 3.54 | 59 | 0.16 | 0.15 |

| Incl. | 0 | 2 | 2 | 1.41 | 97 | 0.31 | 0.13 |

| Incl. | 0 | 1 | 1 | 0.71 | 101 | 0.24 | 0.14 |

| PC24-12 | 0 | 18.8 | 18.8 | 18.80 | 22 | 0.31 | 0.21 |

| Incl. | 13.8 | 16.6 | 2.8 | 2.80 | 36 | 0.75 | 0.4 |

| PC24-13 | 0 | 33.6 | 33.6 | 33.60 | 12.98 | 0.48 | 0.32 |

| Incl. | 5.1 | 6.6 | 1.5 | 1.50 | 33.3 | 0.43 | 0.14 |

| PC24-14 | 0 | 17.8 | 17.8 | 12.59 | 60 | 0.7 | 0.18 |

| Incl. | 8.8 | 17.8 | 9 | 6.36 | 90 | 0.74 | 0.25 |

| Incl. | 16.3 | 17.8 | 1.5 | 1.06 | 185 | 0.58 | 0.33 |

| PC24-18 | 0 | 39.9 | 39.9 | 28.21 | 157 | 0.5 | 0.2 |

| Incl. | 13 | 32.4 | 19.4 | 13.72 | 304 | 0.7 | 0.19 |

| Incl. | 15 | 27.9 | 12.9 | 9.12 | 391 | 0.7 | 0.16 |

| Incl. | 16.5 | 19.5 | 3 | 2.12 | 583.5 | 0.61 | 0.1 |

| PC24-18 | 59.4 | 61.9 | 2.5 | 1.77 | 43 | 0.44 | 0.42 |

| PC24-20 | 0 | 18.4 | 18.4 | 18.40 | 51 | 0.2 | 0.13 |

| Incl. | 3.6 | 17.24 | 13.64 | 13.64 | 58 | 0.2 | 0.13 |

| Incl. | 8.6 | 13.82 | 5.22 | 5.22 | 65 | 0.13 | 0.14 |

| PC24-21 | 12.84 | 18.83 | 5.99 | 5.99 | 30 | 0.13 | 0.13 |

| PC24-22 | 10.5 | 25.22 | 14.72 | 14.72 | 45 | 0.51 | 0.39 |

| Incl. | 18.34 | 25.22 | 6.88 | 6.88 | 77 | 0.64 | 0.28 |

| Incl. | 22.45 | 25.22 | 2.77 | 2.77 | 116 | 0.63 | 0.29 |

| Incl. | 22.45 | 23.82 | 1.37 | 1.37 | 134 | 0.66 | 0.3 |

| PC24-23 | 0 | 23.1 | 23.1 | 23.10 | 138 | 0.26 | 0.1 |

| Incl. | 7.84 | 20.1 | 12.26 | 12.26 | 223 | 0.28 | 0.08 |

| Incl. | 9.19 | 15.94 | 6.75 | 6.75 | 334 | 0.28 | 0.07 |

| Incl. | 13.24 | 15.94 | 2.7 | 2.70 | 360 | 0.32 | 0.06 |

| PC24-28 | 38.5 | 41.5 | 3 | 2.95 | 38.9 | 0.001 | 0.004 |

| Incl. | 40 | 41.5 | 1.5 | 1.48 | 60.9 | 0,001 | 0.004 |

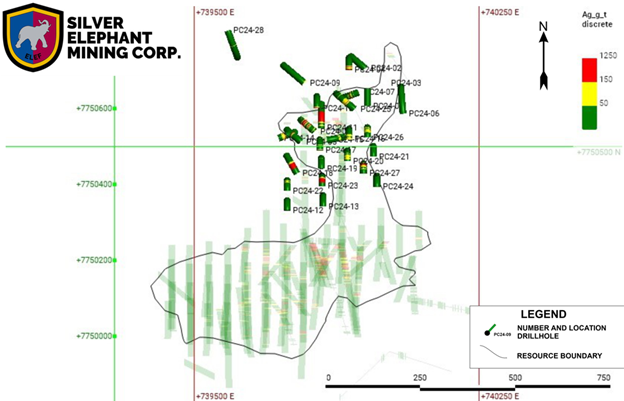

All 28 holes from the drill program shown on the map below:

The Paca project hosts a high-grade silver resource according to a technical report by Mercator Geological Services, dated effective October 13, 2020 titled “Mineral Resource Estimate Technical Report for the Pulacayo Project, Potosi Department Antonio Quijarro Province Bolivia” (the “Technical Report”). The mineral resource estimate from the Technical Report is as follows:

| Paca | Zone | Category | Tonnes | Ag g/t | Ag Moz | Zn% | Pb % |

| Phase 1 | Oxide In Pit | Indicated | 800,000 | 231 | 5.9 | – | – |

| Inferred | 235,000 | 159 | 1.2 | – | – | ||

| Phase 2 | Sulfide In Pit | Indicated | 1,810,000 | 256 | 14.9 | 1.22 | 1.22 |

| Inferred | 190,000 | 338 | 2.1 | 0.61 | 0.98 |

The Technical Report was effective October 13, 2020 and is available under the Company’s profile on SEDAR+ at www.sedarplus.ca. This news release includes an estimate of mineral resources as disclosed in the Technical Report. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Quality Assurance and Quality Control

Silver Elephant adopts industry-recognized best practices in its implementation of QA/QC methods. A geochemical standard control sample, one duplicate and one blank sample are inserted into the sample stream at every 25th sample. Samples are shipped to ALS Global Laboratories in Ururo, Bolivia for preparation. They are then shipped for analysis to ALS Global laboratories in Lima, Peru. Samples are analyzed using Intermediate Level Four Acid Digestion. Silver over limits (“ore grade”) are analyzed using fire assay with a gravimetric finish. ALS Laboratories sample management system meets all the requirements of the International Standards ISO/IEC 17025:2017 and ISO 9001:2015. All ALS geochemical hub laboratories are accredited to ISO/IEC 17025:2017 for specific analytical procedures.

All samples are taken from PQ or HQ diameter core were split in half by a diamond-blade masonry saw. One half of the core is submitted for laboratory analysis and the other half is preserved for reference at the Company’s secured core facility. All the core is geotechnically analyzed, photographed and then logged by geologists prior to sampling.

About Pulacayo-Paca

The Paca project is part of the Company’s Pulacayo-Paca project with a total indicated resource of 106.7 million oz silver, 1.4 billion pounds of zinc and 690 million pounds of lead published in the Technical Report and tabulated below. Silver Elephant and its subsidiaries have spent over $35 million on Pulacayo and Paca, which is considered to be an advanced project with over 96,000 meters of drilling, and a historic feasibility study.

| Combined Pulacayo and Paca Indicated Mineral Resources | ||||

| Tonnes | Ag g/t | Pb % | Zn % | |

| Oxide | 2,185,000 | 155 | – | – |

| Sulfide | 45,855,000 | 65 | 0.69 | 1.37 |

A subsidiary of Silver Elephant entered into a Mining Production Contract (“MPC”) with Corporación Minera de Bolivia (“COMIBOL”), a branch of the Bolivian Ministry of Mining and Metallurgy on October 3, 2019. The MPC grants the Company’s subsidiary an exclusive right to develop and mine at the Pulacayo and Paca concessions for up to 30 years.

The Pulacayo-Paca Project is at the center of a major silver mining district in Bolivia and is within 250 km driving distance to the San Cristobal mine, the Cerro Rico mine, Pan American Silver San Vicente mine, Eloro Resource’s Iska project, and New Pacific Metal’s Silver Sands project.

Qualified Person

The technical contents of this news release have been prepared under the supervision of Carlos Zamora, who is not independent of the Company in that he is employed by it. Mr. Zamora is a qualified person as defined by the guidelines of NI 43-101.

About Silver Elephant Mining Corp.

Silver Elephant is a silver mining company, with its flagship Pulacayo-Paca silver project in production since October 2023 in Bolivia.

Further information on Silver Elephant can be found at www.silverelef.com.

SILVER ELEPHANT MINING CORP.

“John Lee”

Executive Chairman

For more information about Silver Elephant, please contact Investor Relations:

+1.604.569.3661 ext. 101

info@silverelef.com

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes,” “may,” “plans,” “will,” “anticipates,” “intends,” “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Such forward-looking information, which reflects management’s expectations regarding Silver Elephant’s future growth, results of operations, performance, business prospects and opportunities, is based on certain factors and assumptions and involves known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking information. Forward-looking information in this news release includes the expected amount and timing for delivery of Product to Andean, and expected timing and benefits of phase 2 sulphide production for the Paca project.

Forward-looking information involves significant risks and uncertainties, should not be read as a guarantee of future performance, events or results, and may not be indicative of whether such events or results will actually be achieved. A number of risks and other factors could cause actual results to differ materially from expected results discussed in the forward-looking information, including but not limited to: changes in operating plans; ability to secure sufficient financing to advance the Company’s project; conditions impacting the Company’s ability to mine at the project, such as unfavourable weather conditions, development of a mine plan, maintaining existing permits and receiving any new permits required for the project, and other conditions impacting mining generally; maintaining cordial business relations with strategic partners and contractual counter-parties; meeting regulatory requirements and changes thereto; risks inherent to mineral resource estimation, including uncertainty as to whether mineral resources will be further developed into mineral reserves; political risk in the jurisdictions where the Company’s projects are located; commodity price variation; and general market, industry and economic conditions. Additional risk factors are set out in the Company’s latest annual and interim management’s discussion and analysis and annual information form (AIF), available on SEDAR+ at www.sedarplus.ca.

Forward-looking information is based on reasonable assumptions by management as of the date of this news release, and there can be no assurance that actual results will be consistent with any forward-looking information included herein. Readers are cautioned that all forward- looking statements in this news release are made as of the date of this news release. The Company undertakes no obligation to update or revise any forward-looking information in this news release to reflect circumstances or events that occur after the date of this news release, except as required by applicable securities laws.