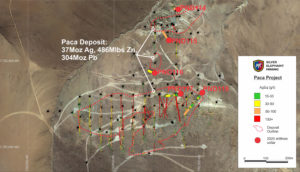

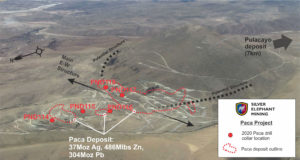

Silver Elephant Intercepts 66 Meters of Mineralization Grading 75 g/t Silver Equivalent in New Discovery Zone at Paca

Vancouver, British Columbia, November 30, 2020 – Silver Elephant Mining Corp. (“Silver Elephant” or “the Company”) (TSX:ELEF, OTCQX:SILEF, Frankfurt:1P2N) announces that further to the news release dated October 14, 2020, it has received the complete assay results from the Company’s diamond drill program at the Paca silver-lead-zinc deposit (“Paca”) in Bolivia.

Paca is a part of the Company’s 100% controlled Pulacayo project, which also includes the Pulacayo deposit in the Potosi department of Bolivia. All 5 drill holes intersected mineralization, with the results shown in the following table:

| Hole ID | From | To | Length (m) | Ag (g/t) | Zn % | Pb % | AuEq* |

| PND114 | 1.5 | 18.0 | 16.5 | 43 | 0.11 | 0.36 | 55 |

| PND115 | 3.0 | 69.0 | 66.0 | 48 | 0.10 | 0.80 | 75 |

| PND116 | 7.0 | 37.0 | 30.0 | 23 | 0.15 | 0.42 | 41 |

| PND117 | 51.0 | 82.0 | 31.0 | 3 | 0.45 | 0.31 | 31 |

| PND118 | 18.0 | 38.0 | 20.0 | 25 | 0.09 | 0.09 | 29 |

| PND118 | 67.0 | 179.0 | 112.0 | 15 | 0.50 | 0.48 | 50 |

| including… | 133.0 | 143.0 | 10.0 | 61 | 0.65 | 0.37 | 93 |

Reported widths are intercepted core lengths and not true widths, as relationships with intercepted structures and contacts vary. Based on core-angle measurements, true widths range from 77% to 86% of the reported core length.

Subscribe to receive Elephant news the moment it’s out by email for free

PND 114, 115, 118 drilled tested oblique structures parallel to the main east-west trend and discovered new mineralized zones.

PND 114 intersected 16.5 meters of mineralization grading 55g/t silver equivalent that is to the north of the Paca north zone.

PND 115 intercepted 66 meters of mineralization grading 75g/t silver equivalent between Paca main zone and Paca north zone, which are 250 meters apart.

PND 118 was drilled at the eastern edge of the Paca main zone and intersected 112 meters of mineralization grading 50 g/t silver equivalent.

The Company is integrating the drill results to the recently completed geomodelling. Commencement of next round of Paca drilling is tentatively scheduled for the first half of 2021.

Danniel Oosterman, Company’s VP of Exploration, states: “We are pleased to see Paca mineralization open to the north and to the east. The Company is well capitalized with $9 million in treasury, and our teams are now in the field preparing for an extensive drill season in 2021 at the Pulacayo, Sunawayo, and El Triunfo projects. Our goal is to significantly expand Silver Elephant’s resource base, which currently stands at 106.7 million oz indicated silver and 13.1 million oz inferred silver*”

*Pulacayo project resource by Mercator Geological Partners, effective October 13, 2020 with details provided in Company’s news release dated October 13, 2020.

Paca maps are posted at http://www.silverelef.com.

Qualified Persons

The technical contents of this news release have been prepared under the supervision of Danniel Oosterman, VP Exploration. Mr. Oosterman is not independent of the Company in that he is employed by it. Mr. Oosterman is a qualified person (“QP”) as defined by the guidelines in NI 43-101.

Quality Assurance and Quality Control

Silver Elephant adopts industry-recognized best practices in its implementation of QA/QC methods. A geochemical standard control sample and a blank sample are inserted into the sample stream at every 20th sample. Duplicates are taken at every 40th sample. Standards and duplicates, including lab duplicates and standards, are analyzed using scatterplots. Samples are shipped to ALS Global Laboratories in Ururo, Bolivia for preparation. They are then shipped for analysis to ALS Global laboratories in Lima, Peru. Samples are analyzed using Intermediate Level Four Acid Digestion. Silver overlimits (“ore grade”) are analyzed using fire assay with a gravimetric finish. ALS Laboratories sample management system meets all the requirements of the International Standards ISO/IEC 17025:2017 and ISO 9001:2015. All ALS geochemical hub laboratories are accredited to ISO/IEC 17025:2017 for specific analytical procedures.

All samples are taken from HQ-diameter core were split in half by a diamond-blade masonry saw. One half of the core is submitted for laboratory analysis and the other half is preserved for reference at the Company’s secured core facility. All the core is geotechnically analyzed and photographed and then logged by geologists prior to sampling.

Subscribe to receive Elephant news the moment it’s out by email for free

About Silver Elephant

Silver Elephant Mining Corp. is a premier silver mining company. The Company’s goal is to enable shareholders to own as much silver in the ground as possible.

Further information on Silver Elephant can be found at www.silverelef.com.

SILVER ELEPHANT MINING CORP.

ON BEHALF OF THE BOARD

“John Lee”

Executive Chairman

For more information about Silver Elephant, please contact Investor Relations:

+1.604.569.3661 ext. 101

ir@silverelef.com www.silverelef.com

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) accepts responsibility for the adequacy or accuracy of this release.

strong>Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, including statements which may contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions, and statements related to matters which are not historical facts, are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management’s expectations regarding Silver Elephant’s future growth, results of operations, performance, business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.

These factors should be considered carefully, and readers should not place undue reliance on the Silver Elephant’s forward-looking statements. Silver Elephant believes that the expectations reflected in the forward-looking statements contained in this news release and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although Silver Elephant has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Silver Elephant undertakes no obligation to release publicly any future revisions to forward-looking statements to reflect events or circumstances after the date of this news or to reflect the occurrence of unanticipated events, except as expressly required by law.