Silver Elephant Signs Definitive Agreement to Acquire Minago Nickel Project in Thompson Nickel Belt Manitoba, Canada

Vancouver, British Columbia, January 22, 2021 – Silver Elephant Mining Corp. (“Silver Elephant” or “the Company”) (TSX:ELEF, OTCQX:SILEF, Frankfurt:1P2N) is pleased to announce that it has entered into a binding definitive Asset Purchase Agreement (the “APA”) with Victory Nickel Inc. (“Victory Nickel”) to acquire the Minago Nickel Project located in Thompson nickel belt (“TNB”), Manitoba, Canada (the “Minago Project”).

Proposed Transaction Summary

Subject to the terms of the APA, Silver Elephant has agreed to acquire the Minago Project from Victory Nickel for aggregate consideration of US$11,675,000, which consists of a US$6,675,000 (“Property Payment”) credit against certain secured debt owed by Victory Nickel to Silver Elephant at closing and US$5,000,000 in Silver Elephant common shares (“Consideration Shares”) to be issued over a one-year period.

Additionally, Silver Elephant will agree to issue to Victory Nickel C$2,000,000 in Silver Elephant common shares, upon the price of nickel exceeding US$10 per pound for 30 consecutive business days, occurring before December 31, 2023.

At closing, pursuant to the APA, Silver Elephant will also subscribe for 40,000,000 common shares of Victory Nickel (each, a “VN Share”) at a price per VN Share of $0.025 for consideration of C$1,000,000.

Closing of contemplated transaction is expected by February 9, 2021, and subject to customary closing conditions, including the final approval of the Toronto Stock Exchange and Canada Stock Exchange.

Dan Oosterman, the Company’s Vice President, Exploration and Canadian Operations states:

“The Minago acquisition immediately propels Silver Elephant to the forefront of the nickel sulphide mining space to supply much needed Class 1 nickel for long-range, high-intensity, fast charging NMC 811 (80% nickel, 10% manganese, 10% cobalt) cathode standard in lithium batteries to fuel mass electric vehicle (EV) adoption.

EV penetration is expected to reach 22 to 30% by 2030 according to a recent research report by Ken Hoffman of Mckinsey & Company. Annual production of 30 million EV’s requires over 2 billion pounds of Class 1 nickel. The 2019 global nickel production was approximately 5 billion pounds consisting of 2.5 billion pounds of Class 1 high-purity nickel from sulphide deposits, and 2.5 billion pounds of Class 2 nickel from laterite deposits. Nickel production from sulphide deposits has been in decline due to their rarity. Silver Elephant’s value proposition is to fill the insatiable and eruptive Class 1 nickel demand from EV’s by expanding nickel sulphide resource at Minago to district scale and eventually bringing the Minago project to production with industry partners.”

Subscribe to receive Elephant news the moment it’s out by email for free

Minago Project Summary

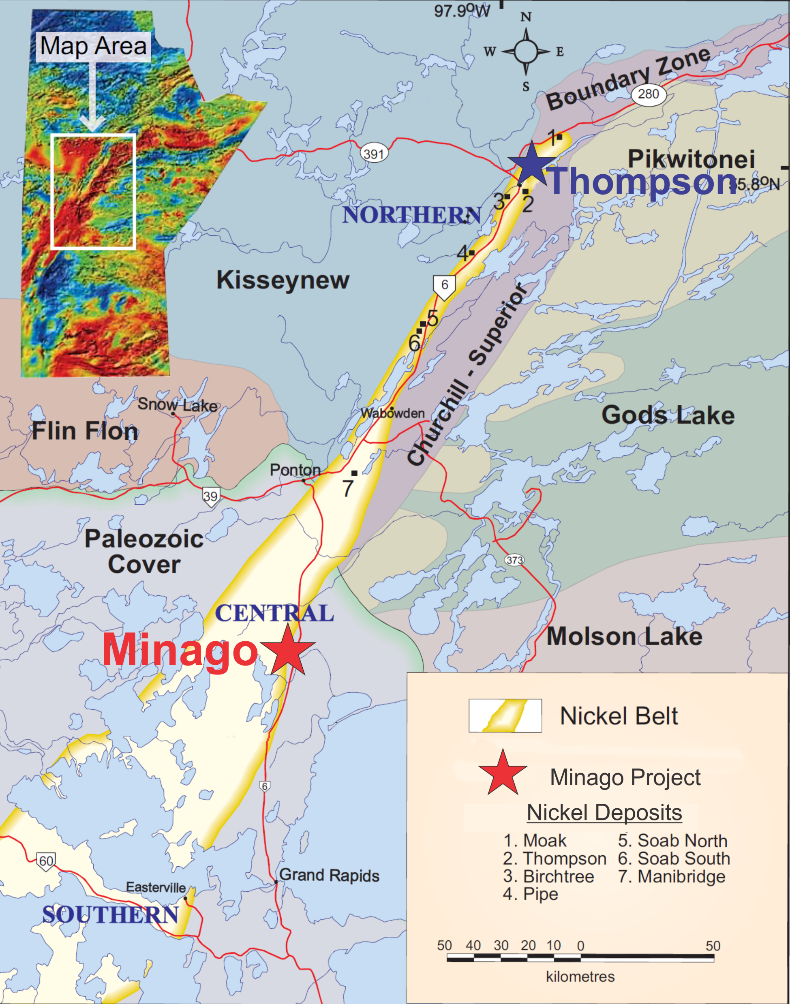

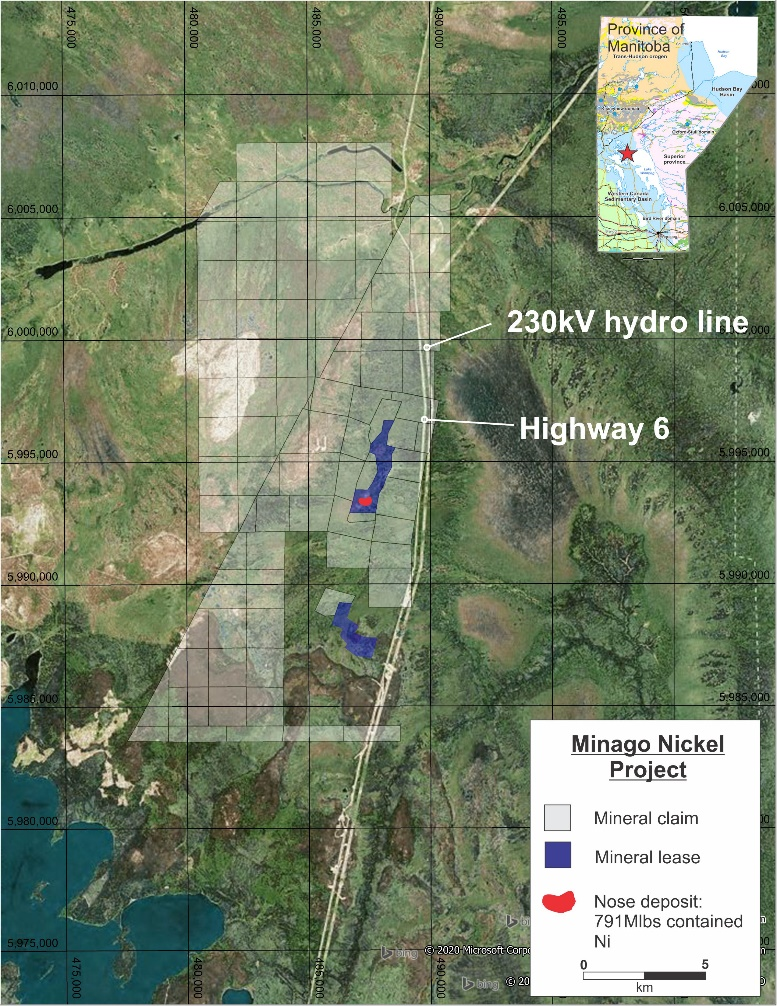

The Minago Project spans over 197 km2 and is in the province of Manitoba, Canada, situated approximately 480km north of Winnipeg and 225km southwest of Thompson.

The Minago Project resides in the southern part of the TNB. It is recognized as the fifth largest nickel-bearing geological belt in the world with over 5 billion pounds of nickel production since 1958. Notable nickel mines include the T1, T3, and Birchtree mines all within a 225 km proximity to the Minago Project. Current annual production by Vale S.A. in the TNB is approximately 33 million pounds.

The project site is close to existing infrastructure, including Manitoba Provincial Highway 6, a 230 kV high voltage transmission line that runs directly beside Highway 6, both of which transect the property. The Property may be served by the Hudson Bay Railway Company (HBR), with rail lines accessible from Ponton, Manitoba, approximately 65 km north of the project.

Resource and Metallurgy

The Minago Project contains a sulphide nickel deposit known as the Nose deposit that was advanced to a feasibility level stage as an open pit mine operation in 2009 by Victory Nickel with a former-NI43-101 compliant resource calculation completed by Wardrop Engineering in 2009 as tabulated below:

| Historic Resource Classification (Wardrop, 2009) | Cutoff | Tonnes (x 1,000) | Ni (%) | Mlbs Ni |

| Measured | >0.25% | 11,051 | 0.56 | 136.4 |

| Indicated | >0.25% | 43,063 | 0.51 | 484.0 |

| Inferred | >0.25% | 14,585 | 0.53 | 170.4 |

A qualified person as defined by NI 43-101 has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. The Company is not treating the historical estimate as current mineral resources or mineral reserves.

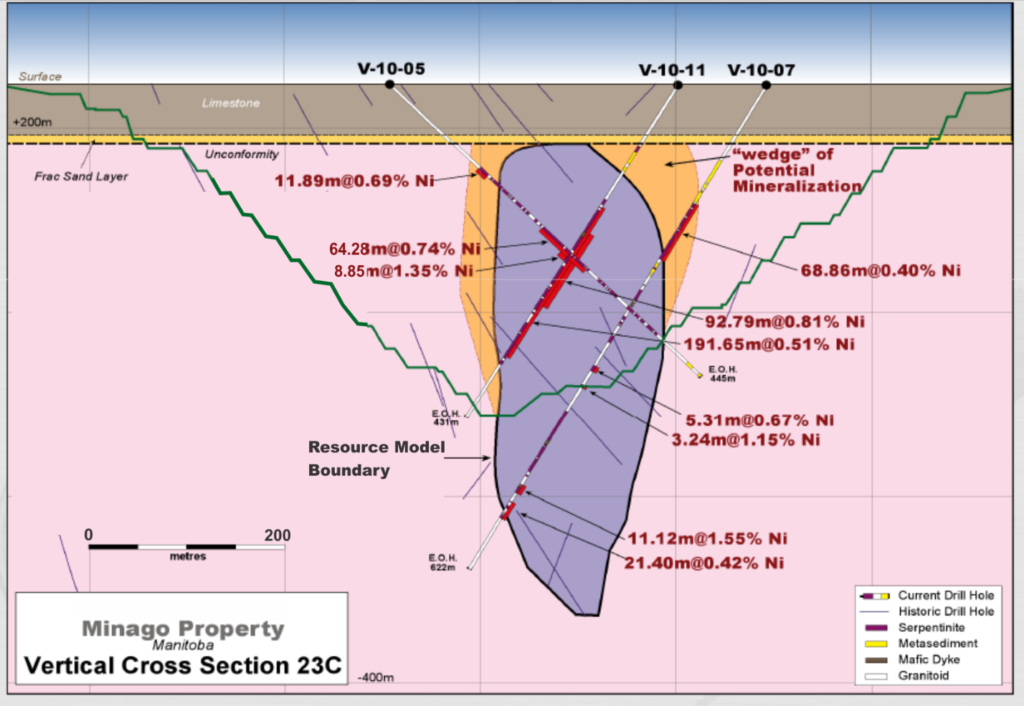

The historic resource estimate database includes 68,092 metres of diamond drilling endowed with zones of wide (i.e. 100 meters+) and continuous mineralization within the Nose deposit. The table below showcases considerable widths through the mineralized zone:

| Hole No | From (m) | To (m) | Int (m) | Ni% |

| V-10-11 | 161.5 | 353.2 | 191.7 | 0.51 |

| V-10-16 | 176.0 | 320.3 | 144.3 | 0.85 |

| V-08-06 | 537.7 | 676.7 | 139.0 | 0.73 |

| V-08-06 | 132.2 | 265.3 | 133.1 | 0.62 |

| V-10-15 | 109.5 | 228.0 | 118.5 | 0.82 |

| V-08-04B | 361.7 | 471.0 | 109.2 | 0.76 |

| N-05-01 | 143.7 | 251.0 | 107.3 | 0.80 |

| MXB-71-94 | 177.4 | 282.2 | 104.9 | 0.73 |

| V-10-26 | 269.2 | 358.8 | 89.5 | 0.86 |

| NM-06-02 | 293.3 | 364.2 | 70.9 | 1.21 |

| N-05-01 | 325.3 | 391.2 | 65.9 | 1.08 |

| V-10-18 | 351.0 | 409.1 | 58.1 | 1.67 |

| B-12A-89 | 322.2 | 372.5 | 50.3 | 1.23 |

| V-08-01 | 452.2 | 490.6 | 38.4 | 1.51 |

Reported widths are core-interval widths and not true widths. True widths have not been determined.

The 2009 feasibility study incorporated metallurgical test work conducted by SGS Lakefield in 2008 which is yet to be verified by the Company. This test work was conducted on a composite of 5 metallurgical drillholes that were designed to have the best representation of the Nose deposits mineralization profile in terms of style and grade. The results of this work indicates that a nickel concentrate containing 22.27% Ni and with an equivalent sulphidic nickel recovery of 77.2%.

Mineralogical work on the nature of the Nose deposit’s nickel sulphides reveals a prevalence of violarite (FeNi2S4) and secondary millerite (NiS). These types of nickel sulphides result in high nickel tenor, which is the concentration of nickel in sulphides, contributing to the high metallurgical recoveries and concentrate grade at the Minago Project.

Exploration Potential

The Minago Project is in the same key geological formation of the Opswagan Group in which the Thompson nickel deposits occur. The orebodies in the Thompson Nickel Belt occur in what is geologically known as the Pipe Formation, specifically within the member known as the P2 schist. Thompson-style mineralization is believed to form as primary nickel sulphide deposits that have undergone remobilization into low-stress structural traps such as fold noses and along fold limbs in pressure shadows and dilatant zones as a result of regional metamorphism.

This has led to several producing mines along the same fold-structure within kilometers of each other—in Thompson this is known as the Thompson Dome, where the Thompson, Birchtree and Pipe mines have collectively produced 150Mt grading 2.32% nickel since 1958.

The Nose deposit at Minago has all the same structural, geological and mineralogical characteristics as the Thompson Dome. Extended mineralization has been defined by drilling along a fold structure within a kilometer north of the Nose deposit known as the North Limb.

The North Limb has received over 6,000 meters of diamond drilling with intercepts of nickel mineralization akin to the grades and widths at the Nose deposit. Some highlights from the drilling completed in 2010 and 2011 along the North Limb are tabulated below:

| DDH No | From (m) | To (m) | Int (m) | Ni (%) |

| V‐10‐02 | 142 | 202.4 | 60.4 | 0.45 |

| incl… | 184.8 | 201 | 16.3 | 0.8 |

| V‐10‐03 | 199.7 | 228.1 | 28.4 | 0.42 |

| V‐10‐03 | 291 | 301.9 | 10.9 | 0.7 |

| V‐10‐04 | 203 | 255 | 52.0 | 0.63 |

| incl… | 206 | 236.5 | 30.5 | 1.01 |

| V‐10‐04 | 263 | 292 | 29.0 | 0.56 |

| incl… | 270 | 281 | 11.0 | 1.08 |

| V‐10‐05 | 280.9 | 298.5 | 17.7 | 0.73 |

| incl… | 282 | 298.5 | 9.5 | 1.07 |

| V‐10‐13 | 180.8 | 314.6 | 133.9 | 0.5 |

| incl… | 259.1 | 312 | 52.8 | 0.61 |

| V-10-21 | 173 | 225.2 | 52.2 | 0.57 |

| V-10-21 | 259.6 | 277.8 | 18.3 | 0.54 |

| V-11-07 | 333 | 347.4 | 14.4 | 0.44 |

| V-11-08 | 301.6 | 327.8 | 26.3 | 0.51 |

| V-11-08 | 339.1 | 359.4 | 20.3 | 0.91 |

| V-11-09 | 266 | 361.5 | 95.5 | 0.72 |

| V-11-10 | 260 | 380.5 | 120.5 | 0.52 |

| incl… | 292.5 | 324 | 31.5 | 0.75 |

| V‐11‐11 | 217.9 | 235 | 17.1 | 0.58 |

| V‐11‐11 | 255 | 304 | 49.0 | 0.56 |

| incl… | 259 | 295 | 36.0 | 0.64 |

| V‐11‐13 | 194.2 | 255.2 | 61.0 | 0.46 |

| incl… | 208 | 237 | 29.0 | 0.6 |

| V‐11‐14 | 302.4 | 338.7 | 36.3 | 0.68 |

Reported widths are core-interval widths and not true widths. True widths have not been determined.

Based on these historic results Victory Nickel engaged AGP Consultants to evaluate the potential of the North Limb and established that a resource target estimate of between 21 million and 34 million tonnes grading 0.49% to 0.59% based on a 0.30% total nickel cut-off that is separate from the Nose deposit. This target estimate has not been verified by the Company.

In addition to the North Limb, drillings completed immediately to the west of Nose (“Nose West Extension”), 10km to the south of Nose (“South Target”), and 3km to the northwest of North Limb (“O Limb”) had all encountered nickel mineralization with highlights below. All those represent priority targets upon which the Company expects to evaluate further.

Nose West Extension highlights:

| DDH No. | From (m) | To (m) | Int (m) | Ni % |

| V-11-21 | 99.15 | 103.27 | 4.12 | 0.77 |

| V-11-21 | 116.08 | 122.54 | 6.46 | 0.39 |

| V-11-23 | 111.5 | 122 | 10.5 | 0.65 |

| V-11-23 | 142.85 | 152 | 9.15 | 1.17 |

| V-11-23 | 157.5 | 165 | 7.5 | 0.55 |

| V-11-23 | 173 | 205.5 | 32.5 | 0.73 |

| incl… | 176.1 | 187.5 | 11.4 | 1.11 |

| V-11-24 | 196.33 | 199.84 | 3.51 | 0.45 |

| V-11-24 | 230 | 233.86 | 3.86 | 0.64 |

Reported widths are core-interval widths and not true widths. True widths have not determined.

South Target highlights:

| DDH No | Int (m) | Ni% |

| A60 | 12.2 | 0.49 |

| A60 | 23.2 | 0.47 |

| A60 | 36.6 | 0.6 |

| A37 | 36.6 | 0.51 |

| A23 | 9.1 | 0.45 |

| A34 | 16.2 | 0.71 |

| A36 | 12.2 | 0.46 |

| A36 | 24.4 | 0.38 |

*Taken from filed assessment maps reporting only width/grade. ‘From’ and ‘To’ meterage not available for these holes. Reported widths are core-interval widths and not true widths. True widths have not determined.

“O” Limb highlights:

| DDH No | From (m) | To (m) | Int (m) | Ni (% ) |

| MN96-141 | 97.86 | 118 | 20.14 | 0.61 |

| MN96-142 | 122.85 | 128 | 5.15 | 1.44 |

| MXB-71-86 | 188.67 | 192.94 | 4.27 | 1.2 |

| MXB-71-86 | 188.67 | 201.01 | 12.34 | 0.86 |

Reported widths are core-interval widths and not true widths. True widths have not been determined.

Further Transaction Details

The US$6,675,000 Property Payment will be made at closing in the form of a credit in the favour of Victory Nickel of US$6,675,000 against an aggregate of approximately US$11,880,000 owed by Victory Nickel pursuant to a Secured Debt Facility (“SDF”)

The current SDF creditor and Silver Elephant have entered into arm-length definitive Debt Purchase and Assignment Agreement (“DPAA”), whereby the SDF creditor will sell and assign the SDF to Silver Elephant for US$6,675,000 payable by Silver Elephant to the SDF creditor at closing of such transaction.

Under the APA, Silver Elephant will further credit the remaining balance under the SDF to Victory Nickel’s benefit, upon the completion of an independent economic study proving positive net present value being prepared in respect of the Minago Project in the future after closing. Silver Elephant will also grant Victory Nickel a right of first refusal till December 31, 2023 to exploit the sandstone (non-nickel bearing sulphides) resources for frac sand extraction at the Minago Project. The Consideration Shares will be issued in three tranches as follows: US$2,000,000 worth of Consideration Shares at Closing; a further US$2,000,000 worth of Consideration Shares on or before August 31, 2021, and a further US$1,000,000 worth of Consideration Shares on or before December 31, 2021, at such timings as may be determined at the sole option of Silver Elephant, all in accordance with the APA.

Concluding Remarks

John Lee, CFA, the Company’s chairman states: “Danniel Oosterman, Silver Elephant’s VP Exploration and Canadian Operations, started his career at Falconbridge and INCO, and helped drill the T3 deposit in Thompson not far from Minago. Silver Elephant has high hopes and aspirations for significant Minago resource expansion and Dan is ideally suited to unveil this great project and explore Minago to its full potential.”

Visit www.silverelef.com for Minago project maps.

Qualified Person

The technical contents of this news release have been prepared under the supervision of Danniel Oosterman, VP Exploration. Mr. Oosterman is not independent of the Company in that he is employed by it. Mr. Oosterman is a qualified person (“QP”) as defined by the guidelines in NI 43-101.

Subscribe to receive Elephant news the moment it’s out by email for free

About Silver Elephant

Silver Elephant Mining Corp. is a premier mining and exploration company of energy metals.

Further information on Silver Elephant can be found at www.silverelef.com.

SILVER ELEPHANT MINING CORP.

ON BEHALF OF THE BOARD

“John Lee”

Executive Chairman

For more information about Silver Elephant, please contact Investor Relations:

+1.604.569.3661 ext. 101

ir@silverelef.com www.silverelef.com

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, including statements which may contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions, and statements related to matters which are not historical facts, are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management’s expectations regarding Silver Elephant’s future growth, results of operations, performance, business prospects and opportunities, are based on certain factors and assumptions, including, but not limited to, the ability of the Company to complete the transactions contemplated by the APA, the ability of the Company to explore the Minago Project, the ability of the Company to capitalize on the Minago Project, global commodities prices and volatility, the ability of the Company to access financing on terms acceptable to the Company, the ability of the Company and Victory Nickel to obtain the approval of the Toronto Stock Exchange and the Canadian Securities Exchange respectively, future exploration and drilling results at the Minago Project and elsewhere, political risks, risks associated with the ongoing COVID-19 pandemic, general economic, social and securities risks, and any other risks noted in the Company’s public disclosure record, and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.