Silver Elephant To Start Sulphide Mining in 2024 at the Paca Project in Bolivia

Vancouver, British Columbia, July 8, 2024 — Silver Elephant Mining Corp. (“Silver Elephant” or the “Company”) (TSX:ELEF, OTC:SILEF, Frankfurt:1P2N) is pleased to announce it intends to begin phase one mining of sulphide materials this year at its Paca silver project in Potosi department in Bolivia.

The company has completed design for a phase one underground mine plan at Paca aimed at extracting approximately 10,000 tonnes of mineralized materials. The objective is to generate cashflow, and verify the Paca resource model. The Paca sulphide project is outside the of scope of the oxide sales and purchase agreement and master services agreement with Andean Precious Metals Corp. (“Andean”) detailed in the news release dated September 12, 2023.

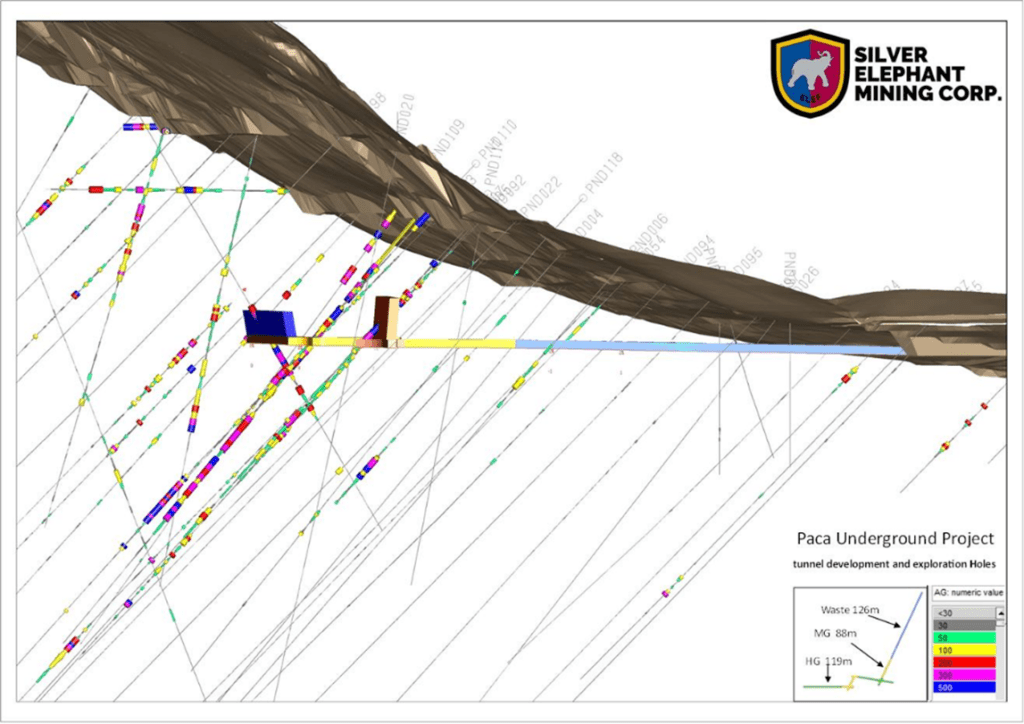

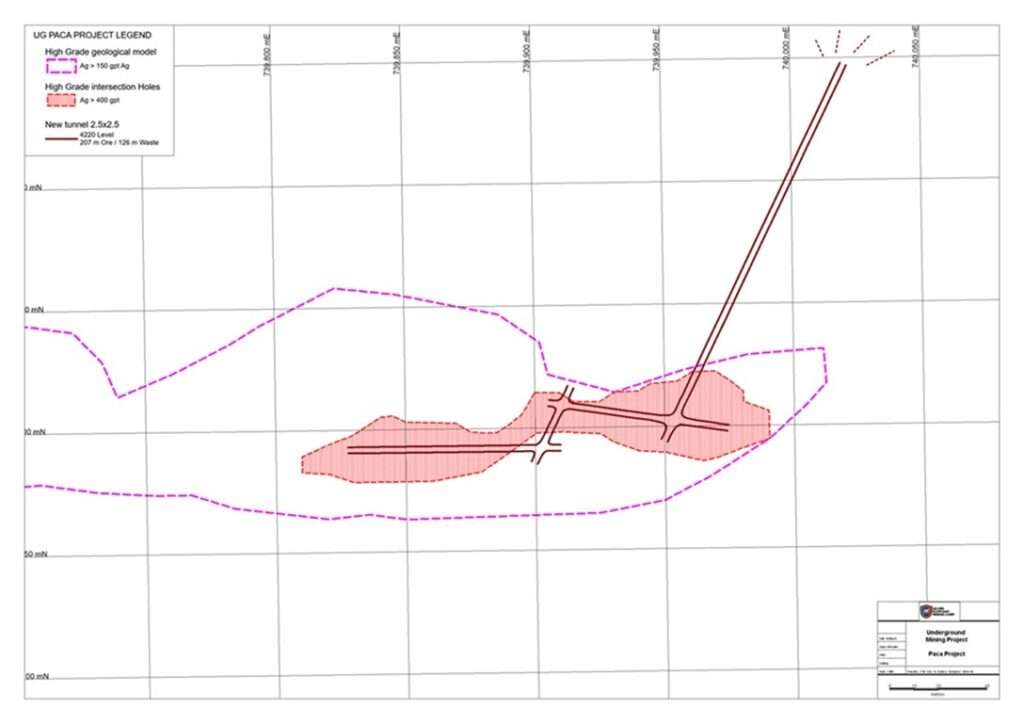

Phase one of the project plan is expected to last approximately 5 months, beginning in September 2024, starting with the development of a 367-meter tunnel at level 0 with dimensions of 2.4 meters height x 2.5 meters width at a 1% inclination into the Paca dome mineralization. The total length of the tunnel will cross an estimated waste section of 160 meters and mineral section of 207 meters.

The tunnel will provide access to the mineralized materials, which will be mined using the shrinkage stoping method. The two stopes are designed with approximate dimensions of 30 meters length x 20 meters height x 4 meters width at a targeted peak extraction rate of 150 tonnes per day from November 2024 to January of 2025. The expected average grade of extracted and sorted sulphide materials is 412 g/t Ag, 1.09% Pb, 0.38% Zn based on diamond drill holes at Paca and internally developed mine model. This material is contained within the Paca Resource estimate

Several examples of high-grade intercepts within the engineered mineralized mining zone include:

| Hole ID | From m | To m | Length m | True Width m | Ag g/t | Pb % | Zn % |

| PND004 | 86 | 97 | 11 | 7.78 | 481 | 0.47 | 0.2 |

| PND008 | 47 | 63 | 16 | 11.31 | 507 | 1.14 | 0.57 |

| PND008 | 111.9 | 127 | 15.1 | 10.68 | 424 | 1.96 | 2.65 |

| PND023 | 125 | 157 | 32 | 26.21 | 437 | 1.69 | 1 |

| PND092 | 38 | 52 | 14 | 9.90 | 522 | 0.77 | 0.09 |

| PND110 | 61 | 72 | 11 | 7.78 | 715 | 2.14 | 210 |

The full drill hole assay results have previously been released on SEDAR.

Capital Expenditure, Processing, and Concentrate Sales

The company owns the necessary underground mining equipment that is warehousednear Paca at the historic Pulacayo mine site. This will be used during phase one mining and will enable minimal startup procurement cost. The equipment inventory was stored there after the trial mining at Pulacayo by the previous operator in 2012.

During Phase one, the Company will truck the mined materials from Paca to Potosi town for toll-milling. Potosi is located about 180 km to the east by paved road. The Company is finalizing agreements with custom mill facilities in Potosi to toll process mineralized materials to produce silver-bearing zinc and lead concentrates. The concentrates will then be sold to one of several major commodity traders active in Potosi.

Tunnel development is expected to start in September with modest capital expenditure of under $200,000 on equipment refurbishment, labor, and consumables. The toll milling and revenue generation is forecast to start in November .

The successful execution of the phase one plan could lead to full scale Paca open pit sulphide mining in 2025, in conjunction with Paca oxide operation, working in collaboration with Andean.

Potosi Region

Potosi town district hosts the Cerro Rico silver deposit and is home to about 100 privately owned, small-sized processing facilities (ranging from 50 to 500 tonnes per day capacity) that produce zinc and lead concentrates sold to many active commodity traders. Potosi department is one of most active silver producing region in the world. Majority of Bolivia’s annual 40 million oz silver production came from Potosi department.

About Pulacayo-Paca

The Pulacayo – Paca silver-zinc-lead project, located in southern Bolivia, is situated near major mining projects operated by Andean Precious Metals Corp. (San Bartolome), Pan American Silver Corp. (San Vicente), and San Cristobal Mining Inc. (San Cristobal).

The Paca project hosts a high grade silver resource according to a technical report by Mercator Geological Services, dated effective October 13, 2020 titled “Mineral Resource Estimate Technical Report for the Pulacayo Project, Potosi Department Antonnio Quijarro Province Bolivia” (the “Technical Report”). The report detailed 1.81 million tons of indicated resources with a grade of 256g/t Ag, 1.22% Pb, and 1.22% Zn (95% of its resources being within 100m from the surface). Additionally, it reported 190,000 tons of inferred resources grading 338g/t Ag, 0.98% Pb, and 0.61% Zn. Notably, the deposit remains open for expansion to the east, west, and at depth beyond the current resource definition boundaries.

The mineral resource estimate from the Technical Report is as follows:

| Paca | Zone | Category | Tonnes | Ag g/t | Ag Moz | Zn% | Pb % |

| Phase 1 | Oxide In Pit | Indicated | 800,000 | 231 | 5.9 | – | – |

| Inferred | 235,000 | 159 | 1.2 | – | – | ||

| Phase 2 | Sulphide In Pit | Indicated | 1,810,000 | 256 | 14.9 | 1.22 | 1.22 |

| Inferred | 190,000 | 338 | 2.1 | 0.61 | 0.98 |

Oxide resources are based on a Pit-constrained estimate using a 90 g/t Ag cutoff. Sulphide resources are based on a pit-constrained estimate using a 200 g/t Ag Eq cutoff. Ag Eq = Silver Equivalent (Recovered) = (Ag g/t*89.2%)+((Pb%*(US$0.95/lb. Pb/14.583 Troy oz./lb./US$17 per Troy oz. Ag)*(10,000*91.9%))+((Zn%*(US$1.16/lb. Zn/14.583 Troy oz./lb./US$17 per Troy oz. Ag)*(10,000*82.9%)). Sulphide zone metal recoveries of 89.2% for Ag, 91.9% for Pb, and 82.9% for Zn were used in the Silver Equivalent (Recovered) equation and reflect metallurgical testing results disclosed previously for the Pulacayo Deposit. Matthew Harrington P. Geo. is the independent Qualified Person for the resource estimate.

The Technical Report was effective October 13, 2020 and is available under the Company’s profile on SEDAR+ at www.sedarplus.ca. This news release includes an estimate of mineral resources as disclosed in the Technical Report. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

QA/QC

An industry standard Quality Assurance/Quality Control program was used during the various drill campaigns. All core and other samples were split with half being bagged, labelled and shipped directly to the laboratory. The other 50% split is retained in a secure facility. Both standards and blanks were inserted at regular intervals within each sample batch prior to shipment to the laboratory. These comprised 3-5% (depending on the phase of the drill campaign) of analyzed material. For further details, the reader is referred to the N.I. 43-101 cited above.

Qualified Person

The technical contents of this news release have been prepared under the supervision of Bill Pincus, who is an independent consultant of the Company. Mr. Pincus is a qualified person as defined by the guidelines of NI 43-101.

About Silver Elephant Mining Corp.

Silver Elephant is a silver mining company, with its flagship Pulacayo-Paca silver project in production since October 2023 in Bolivia.

Further information on Silver Elephant can be found at www.silverelef.com.

SILVER ELEPHANT MINING CORP.

“John Lee”

Executive Chairman

For more information about Silver Elephant, please contact Investor Relations:

+1.604.569.3661 ext. 101

info@silverelef.com

Neither the TSX nor its Regulation Services Provider (as that term is defined in policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION

Certain statements contained in this news release, including statements which may contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions, and statements related to matters which are not historical facts, are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management’s expectations regarding the Company’s future growth, results of operations, performance, business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements. Forward-looking information in this news release include statements regarding the potential of the drilling results disclosed in this news release, and whether current interpretations of drilling results will be confirmed by future work.

Forward-looking statements are based on expectations and reasonable assumptions by management as of the date of this news release, and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed or implied herein, including the results of any future drilling campaigns which may differ from the results expected by management, changes in the Company’s exploration plans, commodity prices, supply and demand, the fact that mineral resources that are not mineral reserves do not have demonstrated economic viability, the Company’s requirements for additional capital, and general economic and market conditions. There can be no assurance that actual results will be consistent with any forward-looking statements included herein. Readers are cautioned that all forward-looking statements in this news release are made as of the date of this news release. The Company undertakes no obligation to update or revise any forward-looking statements in this news release to reflect circumstances or events that occur after the date of this news release, except as required by applicable securities laws.