Silver Elephant’s El Triunfo East Block Drills 25.7 meters of 1.1g/t AuEq in Bolivia, All Three TEB Drill Holes Encountered Gold Mineralisation.

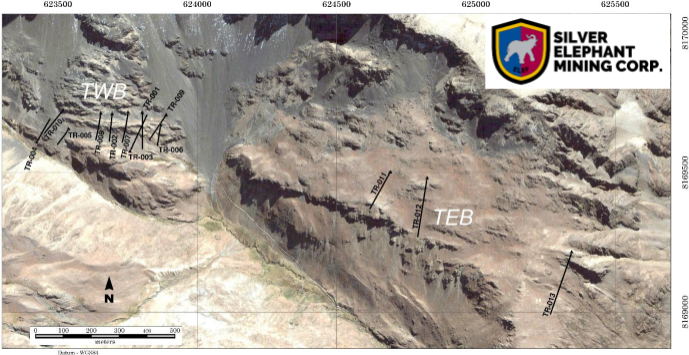

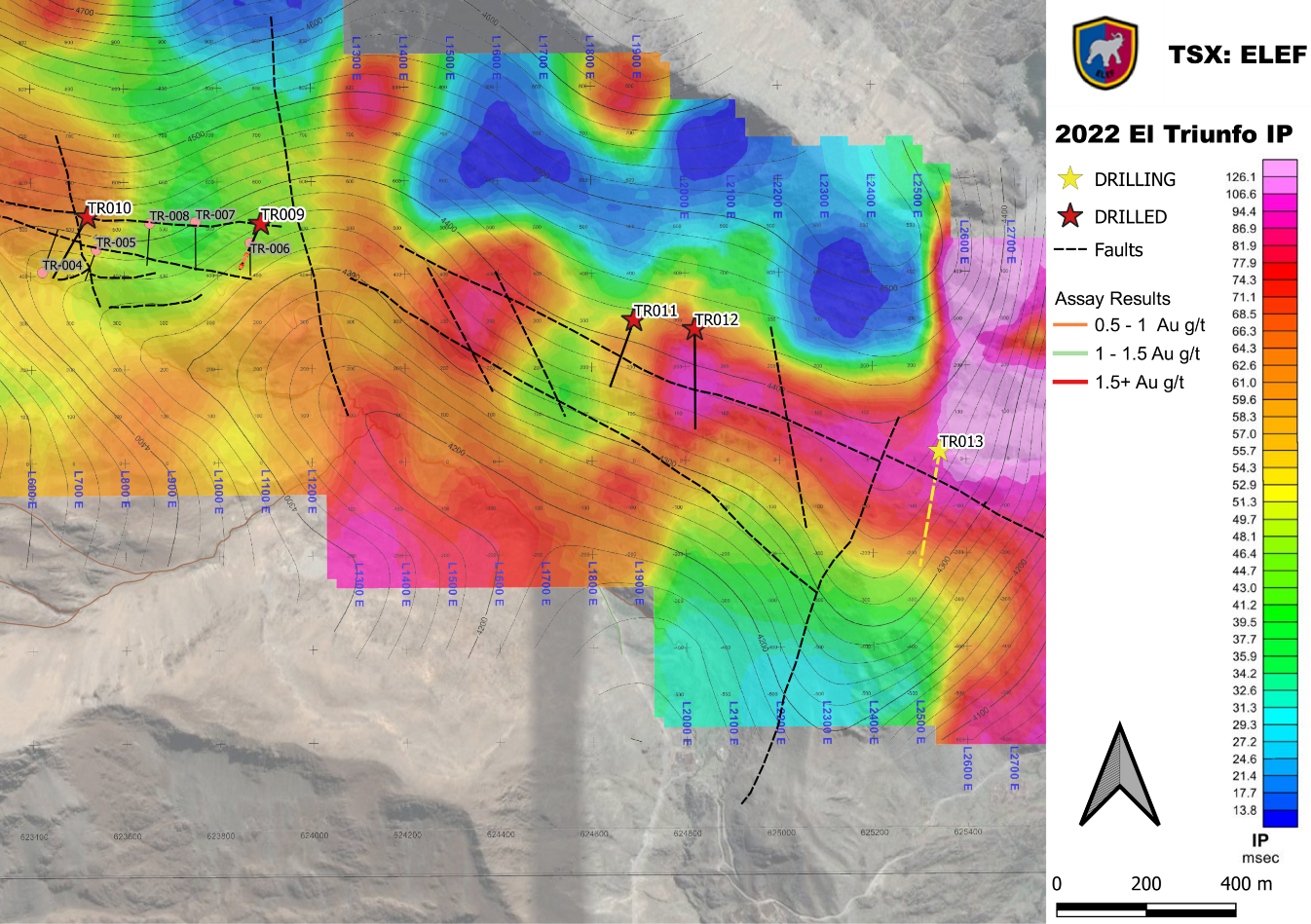

Vancouver, British Columbia, January 12, 2023 – Silver Elephant Mining Corp. (“Silver Elephant”, or the “Company”) (TSX: ELEF, OTCQX: SILEF, Frankfurt: 1P2N) announces diamond drilling results from the Company’s 100%-controlled El Triunfo gold-silver project located 75 km east of La Paz city, Bolivia. Five holes totaling 1,500 meters were drilled on El Triunfo West Block (“TWB”) and newly discovered El Triunfo East Block (“TEB”) based on induced polarization (“IP”) geophysical anomalies identified in 2021.

Triunfo Drill Hole Collar Plan

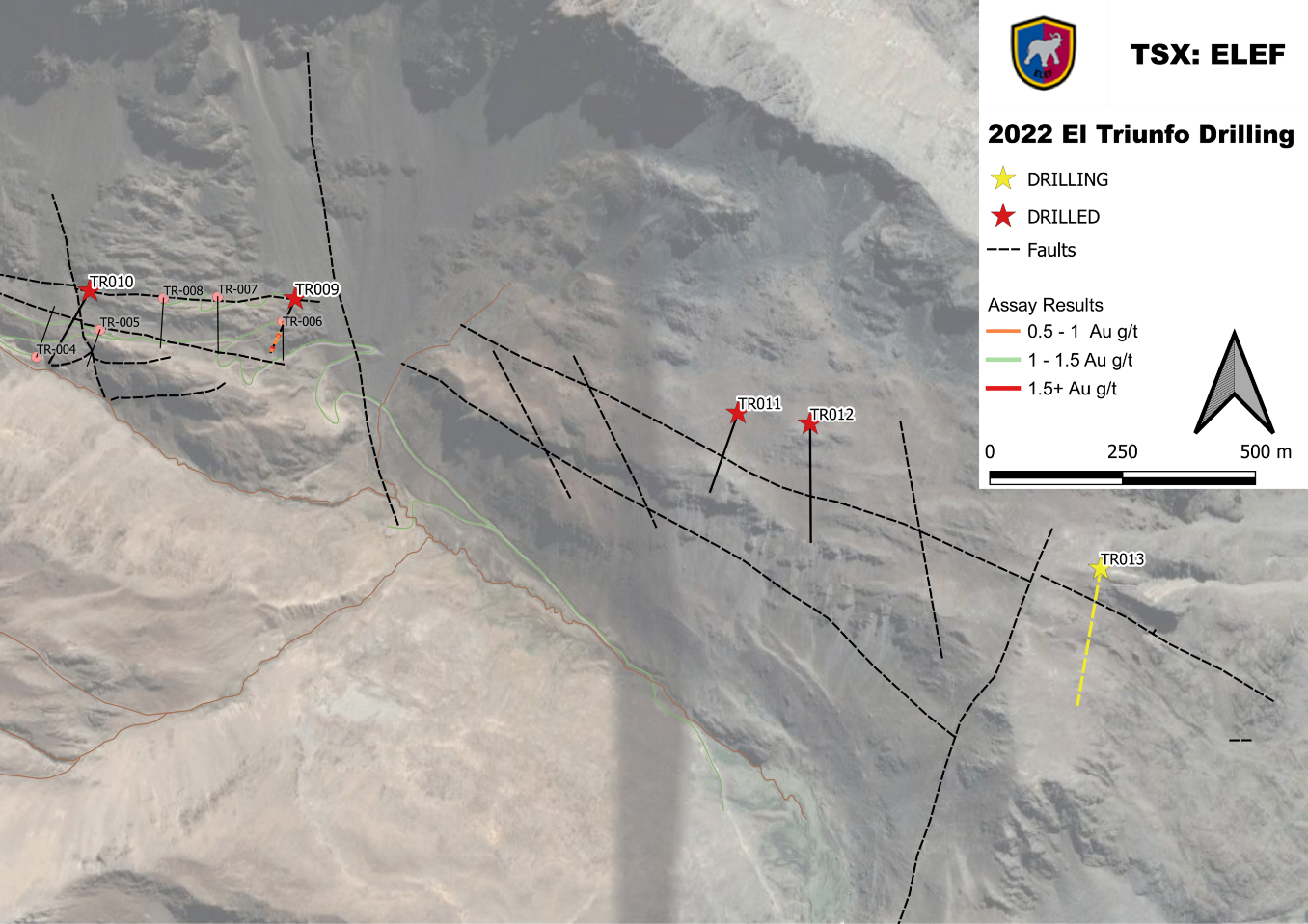

TR-009 encountered 14 meters of 2.5 g/t AuEq and TR010 drilled 1.2 meters of 7.7 g/t within 45 meters grading 0.7 AuEq (see Company’s press release dated April 4, 2022). TR009 and TR010 were drilled at eastern and western edges of the Triunfo West block (known strike 750 meters, “TWB”) and successfully expanded the mineralized width and open up the exploration prospects immediately west of the TWB.

TR011, -012, -013 are drilled at wide spacing at the Triunfo East block (“TEB”), a 1.5 kilometer extension to the TWB that is separated by a fault that resulted in this area being previously unexplored until recently.

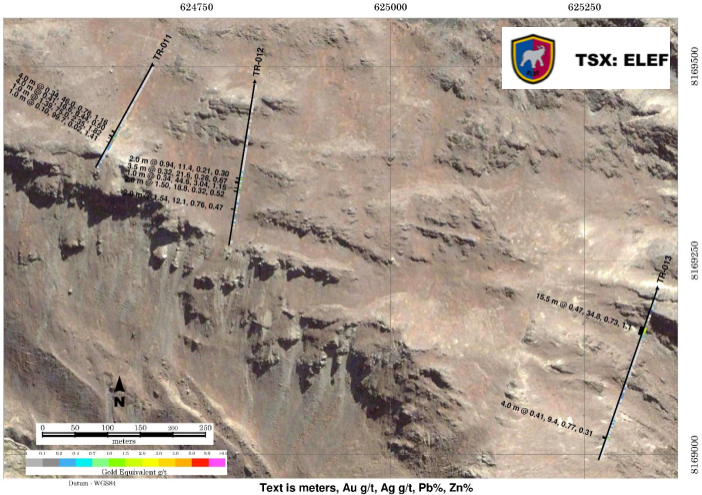

TR-011 encountered separate intersections of 2 meters of 2.87 g/t AuEq (0.42 g/t Au, 81 g/t Ag, 2.04% Pb, 4 meters of 1.72 g/t AuEq (0.34 g/t Au, 46 g/t Ag, 1.16% Pb, 0.78% Zn), and 1.29% Zn), and 1 meter of 3.5 g/t AuEq (1.4 g/t Au, 75 g/t Ag, 1.82% Pb, and 2.35% Zn) within 298 meters grading 0.14 AuEq, starting from 2 meters downhole.

TR-012 encountered 2 meters of 1.3 g/t AuEq (0.94 g/t Au, 11 g/t Ag, 0.30% Pb, 0.21% Zn), 1 meter of 2.76 AuEq (0.34 g/t Au, 45 g/t Ag, 1.15% Pb, 3.04% Zn), 1 meter of 3.4 AuEq (2.7 g/t Au, 26 g/t Ag, 0.671% Pb, 0.583% Zn), and 2 meters of 2.1 g/t AuEq (1.54 g/t Au, 12 g/t Ag, 0.47% Pb, and 0.76% Zn).

TR-013 encountered 25.7 meters of 1.1 g/t AuEq (0.4 g/t Au, 27 g/t Ag, 0.88% Pb, 0.58% Zn), 3 meters of 3.3 AuEq (1.1 g/t Au, 74 g/t Ag, 2.82% Pb, 1.47% Zn), and 2.6 meters of 1.98 AuEq (0.13 g/t Au, 70.3 g/t Ag, 1.72% Pb, 0.68% Zn).

John Lee, CEO of Silver Elephant states: The results from drill holes TR-011, TR-012 and TR-013 triples the strike length of the Truinfo polymetallic target which is now over 2 kilometers long and indicate that a large mineralizing system is present with notable high grade intercepts. Additional geologic work will be conducted to determine the lithologic and structural controls of the mineralization to come up with high grade drill targets.

Reported results are tabulated below:

| Hole ID | From | To | Width (m) | Au (g/t) | Ag (g/t) | Pb % | Zn % | AuEq (g/t) |

| TR-011 | 2.0 | 300.1 | 298.1 | 0.06 | 2.8 | 0.06 | 0.05 | 0.14 |

| incl… | 195.0 | 242.0 | 47.0 | 0.18 | 12.9 | 0.31 | 0.22 | 0.56 |

| …and | 197.0 | 201.0 | 4.0 | 0.34 | 46.0 | 1.16 | 0.78 | 1.72 |

| …and | 198.0 | 200.0 | 2.0 | 0.49 | 80.9 | 2.04 | 1.29 | 2.87 |

| …and | 210.0 | 214.0 | 4.0 | 0.42 | 16.6 | 0.50 | 0.44 | 1.02 |

| …and | 218.0 | 219.0 | 1.0 | 1.39 | 75.0 | 1.82 | 2.35 | 4.12 |

| …and | 229.0 | 230.0 | 1.0 | 0.10 | 99.7 | 1.41 | 0.02 | 1.92 |

| TR-012 | 164.0 | 164.5 | 0.5 | 1.04 | 61.4 | 1.87 | 0.84 | 2.90 |

| 177.0 | 179.0 | 2.0 | 0.94 | 11.4 | 0.30 | 0.21 | 1.30 | |

| 184.0 | 187.5 | 3.5 | 0.32 | 21.7 | 0.67 | 0.28 | 0.97 | |

| 195.0 | 196.0 | 1.0 | 0.34 | 44.6 | 1.15 | 3.04 | 2.76 | |

| 201.0 | 203.0 | 2.0 | 1.50 | 18.8 | 0.52 | 0.32 | 2.08 | |

| 234.0 | 236.0 | 2.0 | 1.54 | 12.1 | 0.47 | 0.76 | 2.22 | |

| TR-013 | 64.3 | 90.0 | 25.7 | 0.32 | 22.2 | 0.73 | 0.48 | 1.09 |

| incl… | 64.3 | 65.0 | 0.7 | 0.52 | 18.5 | 0.54 | 0.72 | 1.29 |

| …and | 75.0 | 83.0 | 8.0 | 0.76 | 41.1 | 1.45 | 0.98 | 2.27 |

| …and | 84.0 | 86.6 | 2.6 | 0.13 | 70.3 | 1.72 | 0.68 | 1.98 |

| …and | 286.0 | 290.0 | 4.0 | 0.41 | 9.4 | 0.31 | 0.77 | 1.00 |

*AuEq: Gold equivalent calculation uses a gold price of $1,815, a zinc price of $1.38, a lead price of $1.07, and a silver price of $24.00 (all USD) and assumes a 100% metallurgical recovery. Gold equivalent values can be calculated using the following formula: AuEq = Au g/t + (Ag g/t x 0.0102) + (Zn % x 0.3551) + (Pb % x 0.3055). Core widths are not true widths. True widths are estimated to range between 45-78% of true widths based on core angle measurements.

Visit www.silverelef.com for El Triunfo maps.

Quality Assurance and Quality Control

Silver Elephant adopts industry-recognized best practices in its implementation of QA/QC methods. Rock chip samples average between 5-7 kilograms. Samples are shipped to ALS Global Laboratories in Ururo, Bolivia for preparation and then shipped to ALS Global laboratories in Lima, Peru for analysis. Samples are analyzed using Intermediate Level Four Acid Digestion. Silver overlimits (“ore grade”) are analyzed using fire assay with a gravimetric finish. The ALS Laboratories sample management system meets all the requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. All ALS geochemical hub laboratories are accredited to ISO/IEC 17025:2017 for specific analytical procedures. A geochemical standard control samples are inserted into the sample stream. The laboratory also includes duplicates of samples, standards and blanks for additional QA/QC. Check assays are reviewed prior to the release of data. Assays are also reviewed for their geological context and checked against field descriptions.

Qualified Person

Mr. Michael R. Schuler supervised the preparation of this news release and approved the scientific and technical information in it. Mr. Schuler is a qualified person as defined by the guidelines in NI 43-101 and is is independent of Silver Elephant Mining Corp.

About Silver Elephant

Silver Elephant Mining Corp. is a premier silver mining and exploration company that is developing 100% owned Pulacayo silver and El Triunfo gold projects in Bolivia. Silver Elephant also owns 100% of Mega Thermal Coal Corp. and 39% of Oracle Commodity Holding Corp. with equity and royalty holdings in nickel and vanadium.

Further information on Silver Elephant can be found at www.silverelef.com

SILVER ELEPHANT MINING CORP.

ON BEHALF OF THE BOARD

“John Lee”

Executive Chairman

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Toronto Stock Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, including statements which may contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions, and statements related to matters which are not historical facts, are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management’s expectations regarding Silver Elephant’s future growth, results of operations, performance, business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.

These factors should be considered carefully, and readers should not place undue reliance on the Silver Elephant’s forward-looking statements. Silver Elephant believes that the expectations reflected in the forward-looking statements contained in this news release and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although Silver Elephant has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Silver Elephant undertakes no obligation to release publicly any future revisions to forward-looking statements to reflect events or circumstances after the date of this news or to reflect the occurrence of unanticipated events, except as expressly required by law.